Question: Question 3 --/1 View Policies Current Attempt in Progress The shareholders' equity accounts of Crane Inc. at December 31, 2020, are as follows: Preferred shares,

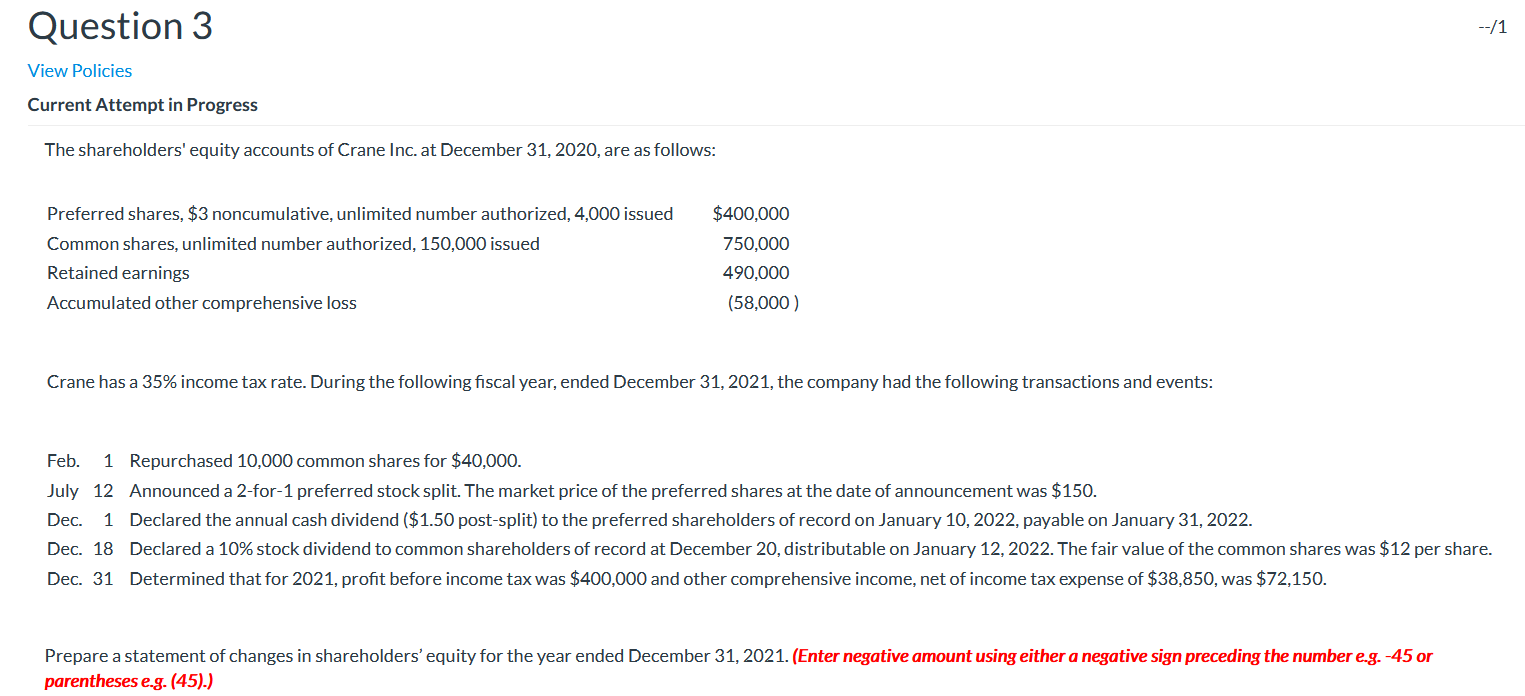

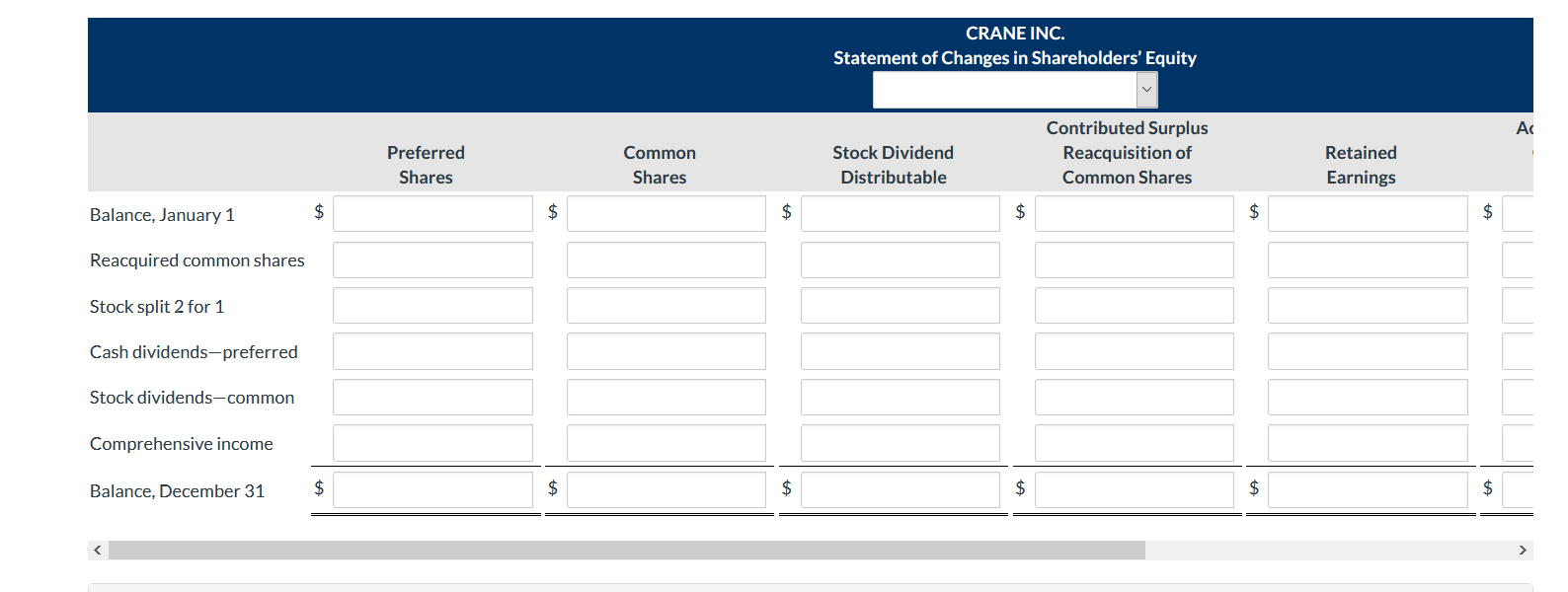

Question 3 --/1 View Policies Current Attempt in Progress The shareholders' equity accounts of Crane Inc. at December 31, 2020, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 4,000 issued Common shares, unlimited number authorized, 150,000 issued Retained earnings Accumulated other comprehensive loss $400,000 750,000 490,000 (58,000) Crane has a 35% income tax rate. During the following fiscal year, ended December 31, 2021, the company had the following transactions and events: Feb. 1 Repurchased 10,000 common shares for $40,000. July 12 Announced a 2-for-1 preferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec. 1 Declared the annual cash dividend ($1.50 post-split) to the preferred shareholders of record on January 10, 2022, payable on January 31, 2022. Dec. 18 Declared a 10% stock dividend to common shareholders of record at December 20, distributable on January 12, 2022. The fair value of the common shares was $12 per share. Dec. 31 Determined that for 2021, profit before income tax was $400,000 and other comprehensive income, net of income tax expense of $38,850, was $72,150. Prepare a statement of changes in shareholders' equity for the year ended December 31, 2021. (Enter negative amount using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) CRANE INC. Statement of Changes in Shareholders' Equity Ac Preferred Shares Common Shares Stock Dividend Distributable Contributed Surplus Reacquisition of Common Shares Retained Earnings Balance, January 1 $ $ $ $ $ $ Reacquired common shares Stock split 2 for 1 Cash dividends-preferred Stock dividends-common Comprehensive income Balance, December 31 $ $ $ $ $ $ CRANE INC. Statement of Changes in Shareholders' Equity Common Shares Stock Dividend Distributable Contributed Surplus Reacquisition of Common Shares Retained Earnings Accumulated Other Comprehensive Income (Loss) Total $ $ $ $ $ $ $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts