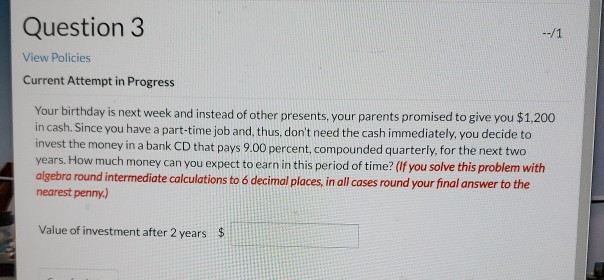

Question: Question 3 --/1 View Policies Current Attempt in Progress Your birthday is next week and instead of other presents, your parents promised to give you

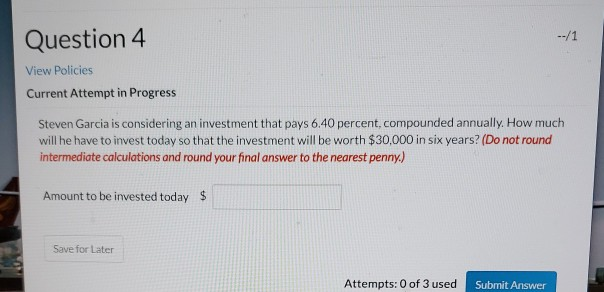

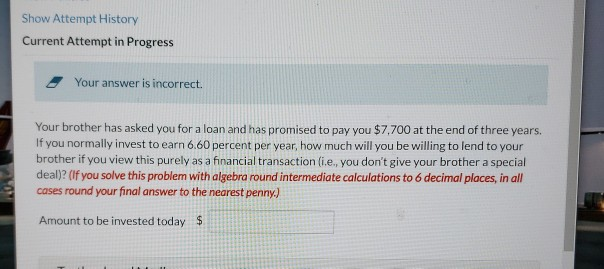

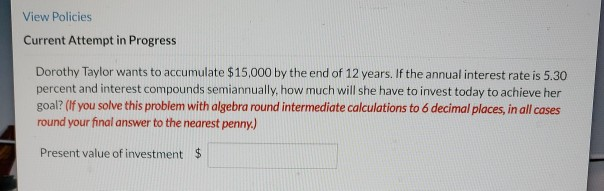

Question 3 --/1 View Policies Current Attempt in Progress Your birthday is next week and instead of other presents, your parents promised to give you $1,200 in cash. Since you have a part-time job and thus, don't need the cash immediately, you decide to invest the money in a bank CD that pays 9.00 percent, compounded quarterly, for the next two years. How much money can you expect to earn in this period of time? (If you solve this problem with algebra round intermediate calculations to 6 decimal places, in all cases round your final answer to the nearest penny.) Value of investment after 2 years $ Question 4 --11 View Policies Current Attempt in Progress Steven Garcia is considering an investment that pays 6.40 percent, compounded annually. How much will he have to invest today so that the investment will be worth $30,000 in six years? (Do not round intermediate calculations and round your final answer to the nearest penny) Amount to be invested today $ Save for Later Attempts: 0 of 3 used Submit Answer Show Attempt History Current Attempt in Progress Your answer is incorrect. Your brother has asked you for a loan and has promised to pay you $7,700 at the end of three years. If you normally invest to earn 6.60 percent per year how much will you be willing to lend to your brother if you view this purely as a financial transaction (ie, you don't give your brother a special deal)? (If you solve this problem with algebra round intermediate calculations to 6 decimal places, in all cases round your final answer to the nearest penny.) Amount to be invested today $ View Policies Current Attempt in Progress Dorothy Taylor wants to accumulate $15,000 by the end of 12 years. If the annual interest rate is 5.30 percent and interest compounds semiannually, how much will she have to invest today to achieve her goal? (if you solve this problem with algebra round intermediate calculations to 6 decimal places, in all cases round your final answer to the nearest penny) Present value of investment $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts