Question: Question 3 1. What does the call provision for a bond entitle the issuer to do? (a) What is the advantage of a call feature

Question 3

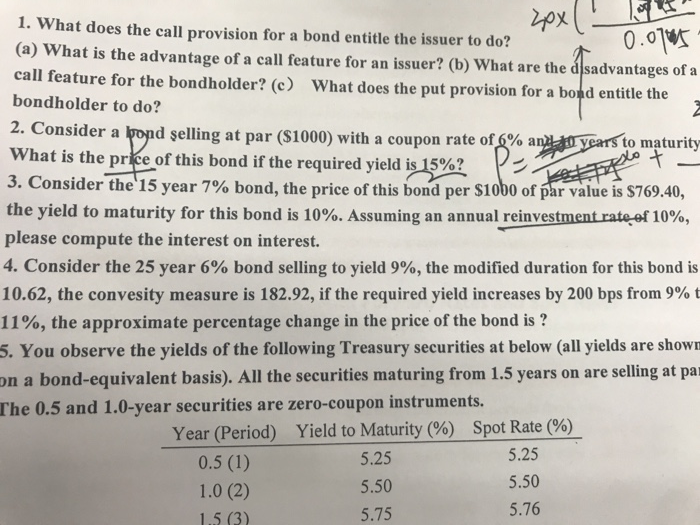

Question 31. What does the call provision for a bond entitle the issuer to do? (a) What is the advantage of a call feature for an issuer? (b) What are the dsadvantages of a call feature for the bondholder? (c) What does the put provision for a bond entitle the. bondholder to do? 0.0 2. Consider a ond selling at par (S1000) with a coupon rate of 6% an pars o maturity What is the price of this bond if the required yield is 15% 3. Consider the' 15 year 7% bond, the price of this bond per $1ob0 of phr value is $769.40, the yield to maturity for this bond is 10%. Assuming an annual reinvestmentrateof 10%, please compute the interest on interest. 4. Consider the 25 year 6% bond selling to yield 9%, the modified duration for this bond is 10.62, the convesity measure is 182.92, if the required yield increases by 200 bps from 9% t 11%, the approximate percentage change in the price of the bond is ? 5. You observe the yields of the following Treasury securities at below (all yields are shown on a bond-equivalent basis). All the securities maturing from 1.5 years on are selling at par 0.5 and 1.0-year securities are zero-coupon instruments. The Spot Rate (96) Yield to Maturity (%) Year (Period) 5.25 5.50 5.76 5.25 5.50 5.75 1.0 (2) 1.5 (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts