Question: Question 3 (10 marks) a) Six mutually exclusive projects A-F are being considered by a company. They have been ordered by first costs so that

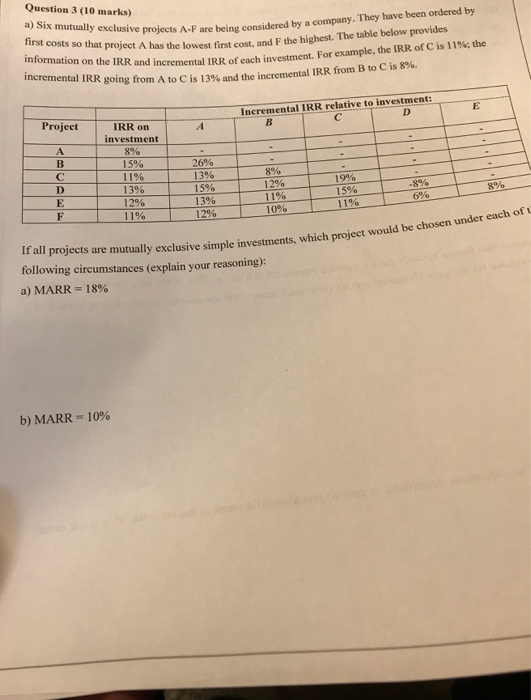

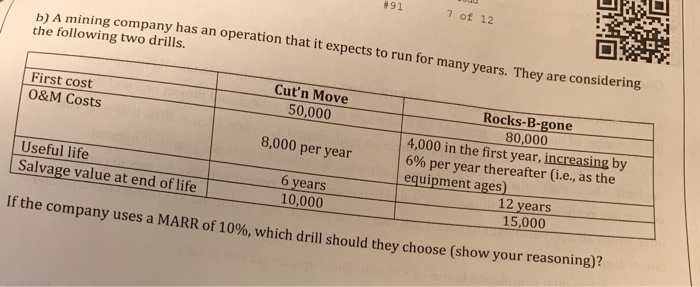

Question 3 (10 marks) a) Six mutually exclusive projects A-F are being considered by a company. They have been ordered by first costs so that project A has the lowest first cost, and F the highest. The table below provides information on the IRR and incremental IRR of each investment. For example, the IRR of C is 11 % ; the incremental IRR going from A to C is 13 % and the incremental IRR from B to C is 8%. Incremental IRR relative to investment: D E Project IRR on investment A A 8% 15% 11% 26% C 8% 12% 11% 13% 19% 15% 13% 12% 11% 15% 13% 12% -8 % 6% 8% 11% F 10% If all projects are mutually exclusive simple investments, which project would be chosen under each of t following circumstances (explain your reasoning): a) MARR 18 % b) MARR 10% 91 7 of 12 A mining company has an operation that it expects to run for many years. They are considering the following two drills Cut'n Move Rocks-B-gone 80,000 4,000 in the first year, increasing by 6% per year thereafter (i.e., as the First cost O&M Costs 50,000 8,000 per year equipment ages) Useful life 6 years 10,000 12 years 15,000 Salvage value at end of life If the company uses a MARR of 10%, which drill should they choose (show your reasoning)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts