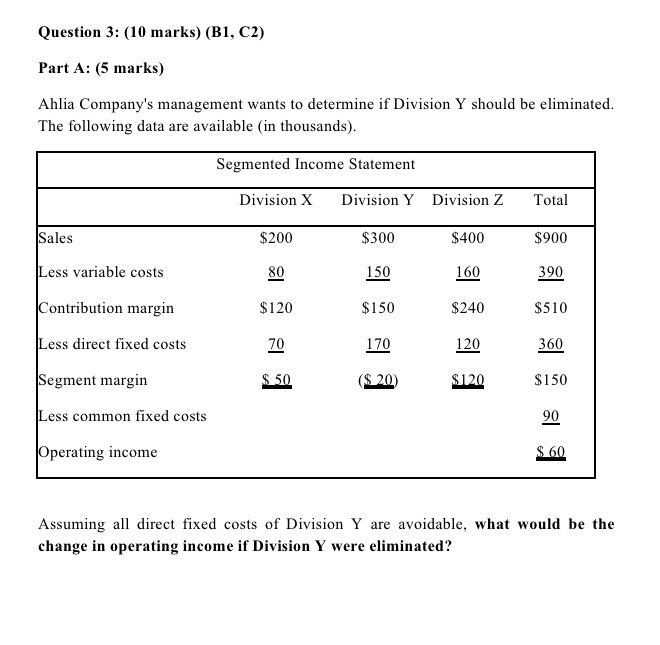

Question: Question 3: (10 marks) (B1, C2) Part A: (5 marks) Ahlia Company's management wants to determine if Division Y should be eliminated. The following data

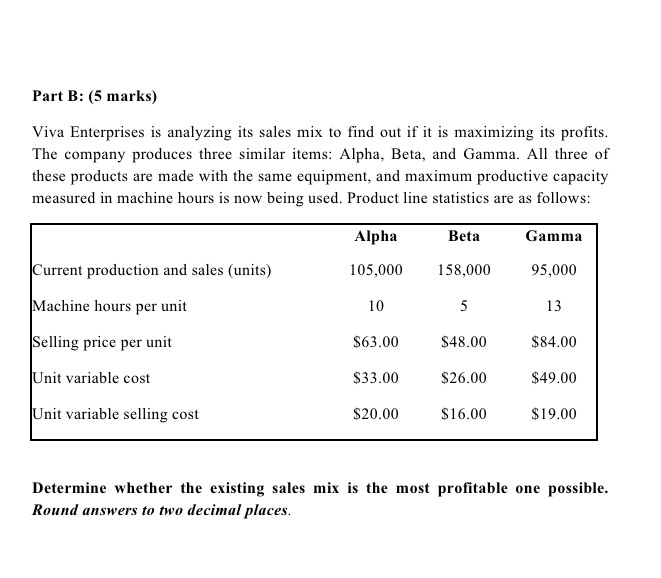

Question 3: (10 marks) (B1, C2) Part A: (5 marks) Ahlia Company's management wants to determine if Division Y should be eliminated. The following data are available in thousands). Segmented Income Statement Division X Division Y Division Z Total Sales $200 $300 $400 $900 Less variable costs 80 150 160 390 Contribution margin $120 $150 $240 $510 Less direct fixed costs 170 120 360 Segment margin ($ 20) $120 $150 Less common fixed costs Operating income Assuming all direct fixed costs of Division Y are avoidable, what would be the change in operating income if Division Y were eliminated? Part B: (5 marks) Viva Enterprises is analyzing its sales mix to find out if it is maximizing its profits. The company produces three similar items: Alpha, Beta, and Gamma. All three of these products are made with the same equipment, and maximum productive capacity measured in machine hours is now being used. Product line statistics are as follows: Alpha Beta Gamma Current production and sales (units) 105,000 158,000 95,000 Machine hours per unit 10 13 Selling price per unit $63.00 $48.00 $84.00 Unit variable cost $33.00 $26.00 $49.00 Unit variable selling cost $20.00 $16.00 $19.00 Determine whether the existing sales mix is the most profitable one possible. Round answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts