Question: Question 3 (10 marks) Consider an investor with an initial wealth of $5 with the following utility function: for 2 > 5 10 Cal Draw

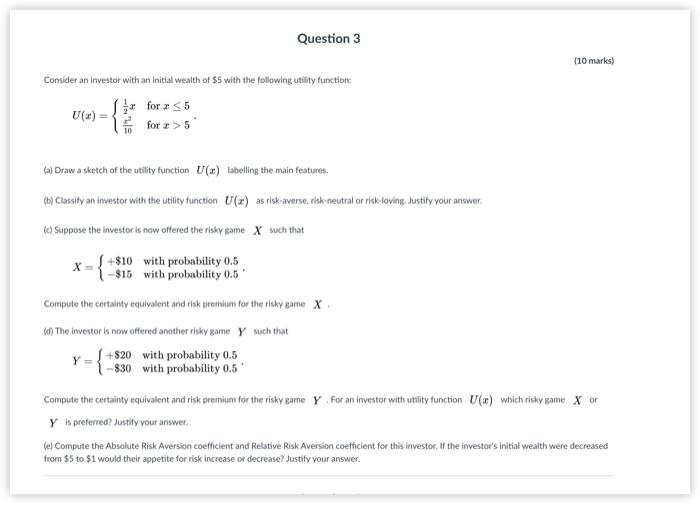

Question 3 (10 marks) Consider an investor with an initial wealth of $5 with the following utility function: for 2 > 5 10 Cal Draw a sketch of the utility function U(x) labelling the main features. (by Classify an investor with the utility function U(x) as risk-averse, nisk-neutral or risk-loving, Justify your answer. (c) Suppose the investor is now offered the risky game x such that x +$10 with probability 0.5 |-$15 with probability 0.5 Compute the certainty equivalent and risk premium for the risky game X 6. The investor is now offered another risky game y such that +820 with probability 0.5 -$30 with probability 0.5 Compute the certainty equivalent and risk premium for the risky game Y For an investor with utility function U(x) which risky came X or Y is preferred? Justify your answer (el Compute the Absolute Risk Aversion coefficient and Relative Risk Aversion coefficient for this investor. If the investor's initial wealth were decreased from $5 to $1 would their appetite for risk increase or decrease? Justify your answer. Question 3 (10 marks) Consider an investor with an initial wealth of $5 with the following utility function: for 2 > 5 10 Cal Draw a sketch of the utility function U(x) labelling the main features. (by Classify an investor with the utility function U(x) as risk-averse, nisk-neutral or risk-loving, Justify your answer. (c) Suppose the investor is now offered the risky game x such that x +$10 with probability 0.5 |-$15 with probability 0.5 Compute the certainty equivalent and risk premium for the risky game X 6. The investor is now offered another risky game y such that +820 with probability 0.5 -$30 with probability 0.5 Compute the certainty equivalent and risk premium for the risky game Y For an investor with utility function U(x) which risky came X or Y is preferred? Justify your answer (el Compute the Absolute Risk Aversion coefficient and Relative Risk Aversion coefficient for this investor. If the investor's initial wealth were decreased from $5 to $1 would their appetite for risk increase or decrease? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts