Question: Question 3 (10 marks) On May 26th, 2013 Calloway Real Estate Investment Trust (Calloway) announced that it would redeem its $75 million 7.95% Series

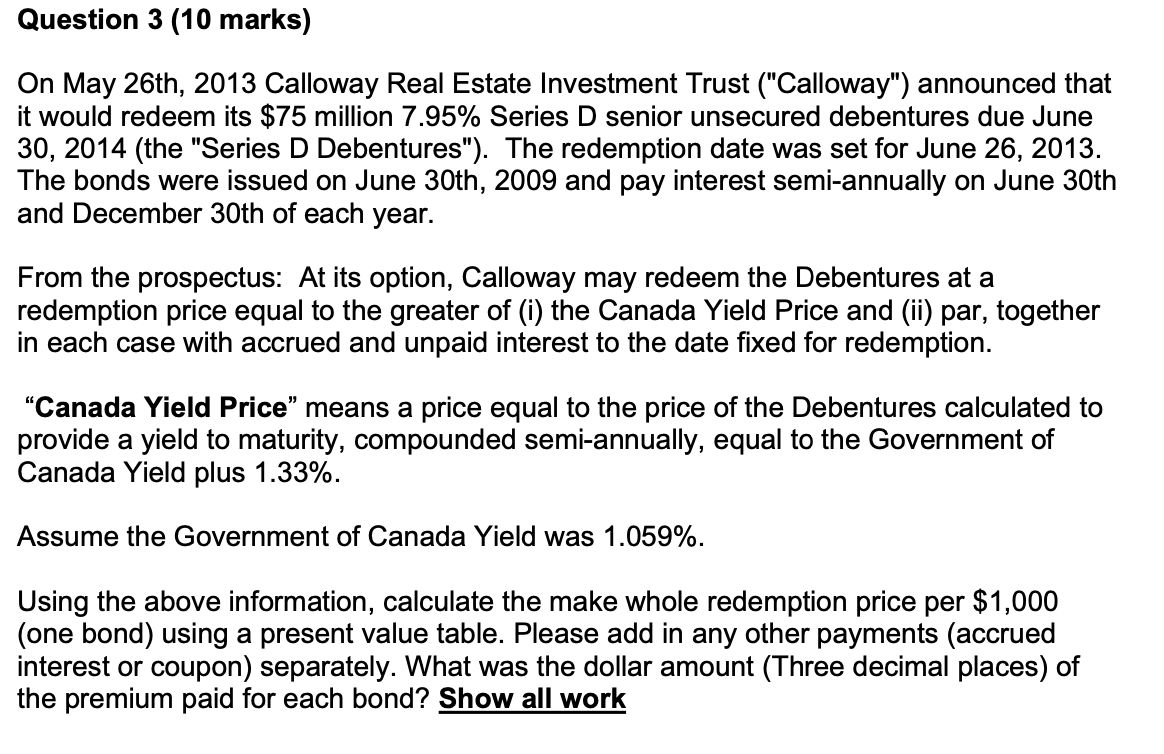

Question 3 (10 marks) On May 26th, 2013 Calloway Real Estate Investment Trust ("Calloway") announced that it would redeem its $75 million 7.95% Series D senior unsecured debentures due June 30, 2014 (the "Series D Debentures"). The redemption date was set for June 26, 2013. The bonds were issued on June 30th, 2009 and pay interest semi-annually on June 30th and December 30th of each year. From the prospectus: At its option, Calloway may redeem the Debentures at a redemption price equal to the greater of (i) the Canada Yield Price and (ii) par, together in each case with accrued and unpaid interest to the date fixed for redemption. "Canada Yield Price means a price equal to the price of the Debentures calculated to provide a yield to maturity, compounded semi-annually, equal to the Government of Canada Yield plus 1.33%. Assume the Government of Canada Yield was 1.059%. Using the above information, calculate the make whole redemption price per $1,000 (one bond) using a present value table. Please add in any other payments (accrued interest or coupon) separately. What was the dollar amount (Three decimal places) of the premium paid for each bond? Show all work

Step by Step Solution

There are 3 Steps involved in it

To calculate the makewhole redemption price per 1000 bond we first need to determine the present value of the remaining cash flows interest payments a... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

66425239b51c6_982795.pdf

180 KBs PDF File

66425239b51c6_982795.docx

120 KBs Word File