Question: Question 3 (10 marks) Silvia is a teacher employed by SCHE Education at their Melbourne campus. She lives in Pakenham with her family on the

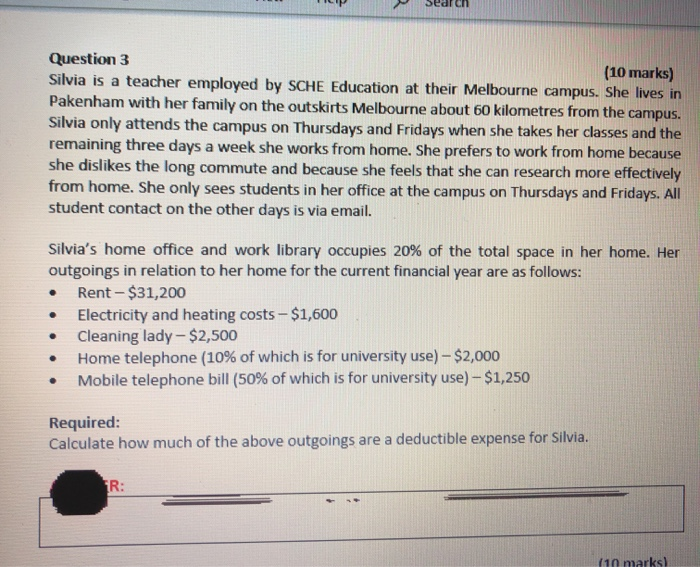

Question 3 (10 marks) Silvia is a teacher employed by SCHE Education at their Melbourne campus. She lives in Pakenham with her family on the outskirts Melbourne about 60 kilometres from the campus. Silvia only attends the campus on Thursdays and Fridays when she takes her classes and the remaining three days a week she works from home. She prefers to work from home because she dislikes the long commute and because she feels that she can research more effectively from home. She only sees students in her office at the campus on Thursdays and Fridays. All student contact on the other days is via email. Silvia's home office and work library occupies 20% of the total space in her home. Her outgoings in relation to her home for the current financial year are as follows: Rent - $31,200 Electricity and heating costs - $1,600 Cleaning lady - $2,500 Home telephone (10% of which is for university use) $2,000 Mobile telephone bill (50% of which is for university use) - $1,250 . . Required: Calculate how much of the above outgoings are a deductible expense for Silvia. R: (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts