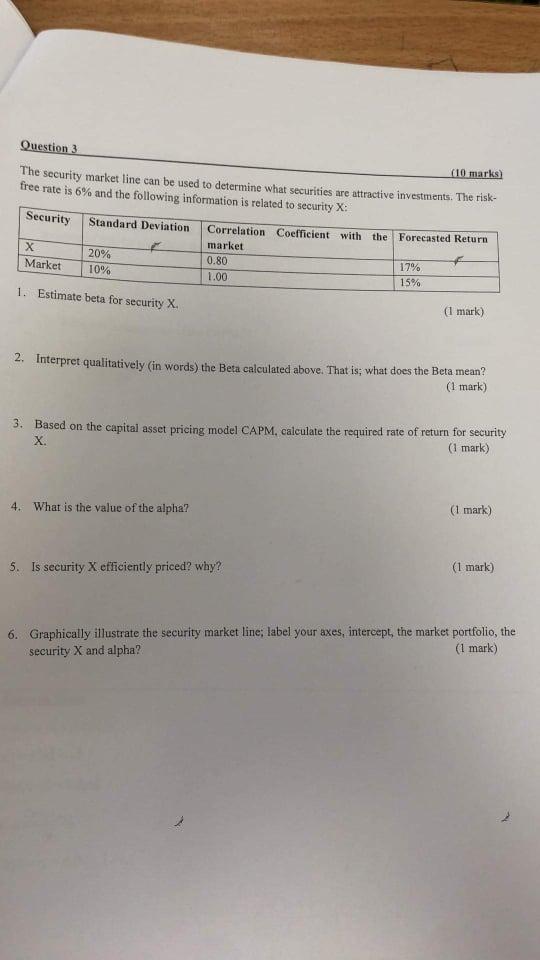

Question: Question 3 (10 marks) The security market line can be used to determine what securities are attractive investments. The risk- free rate is 6% and

Question 3 (10 marks) The security market line can be used to determine what securities are attractive investments. The risk- free rate is 6% and the following information is related to security X: Security Standard Deviation Correlation coefficient with the Forecasted Return market 20% Market 10% 0.80 1.00 17% 15% 1. Estimate beta for security X. (1 mark) 2. Interpret qualitatively in words) the Beta calculated above. That is: what does the Beta mean? (1 mark) 3. Based on the capital asset pricing model CAPM. calculate the required rate of return for security X. (1 mark) 4. What is the value of the alpha? (1 mark) 5. Is security X efficiently priced? why? (1 mark) 6. Graphically illustrate the security market line; label your axes, intercept, the market portfolio, the security X and alpha? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts