Question: Question 3. (10 marks) We consider the Black-Scholes model with interest rate r=0 so that the stock price follows dSt=StdWt,t0 where W is a standard

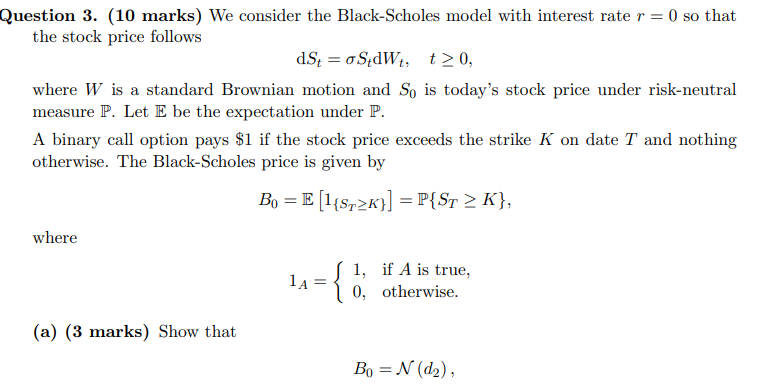

Question 3. (10 marks) We consider the Black-Scholes model with interest rate r=0 so that the stock price follows dSt=StdWt,t0 where W is a standard Brownian motion and S0 is today's stock price under risk-neutral measure P. Let E be the expectation under P. A binary call option pays $1 if the stock price exceeds the strike K on date T and nothing otherwise. The Black-Scholes price is given by B0=E[1{STK}]=P{STK} where 1A={1,0,ifAistrueotherwise. (a) (3 marks) Show that B0=N(d2), where N() is the cumulative normal distribution function and d2:=Tlog(S0/K)212T. (b) (1 mark) A binary log call option pays $1 if logSTlogK and nothing otherwise. Explain why this contract has the same price as the binary call option. (c) (1 mark) Let C0 denote the Black-Scholes price of a regular European call option with strike K. Its payoff is h(ST)=(STK)+,ST>0. Fixing ST, what is the derivative of h with respect to K for K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts