Question: QUESTION 3 10 point Company A's bank statement dated Dec 31, 2011 shows a balance of $24,594.72. The company's cash records on the same date

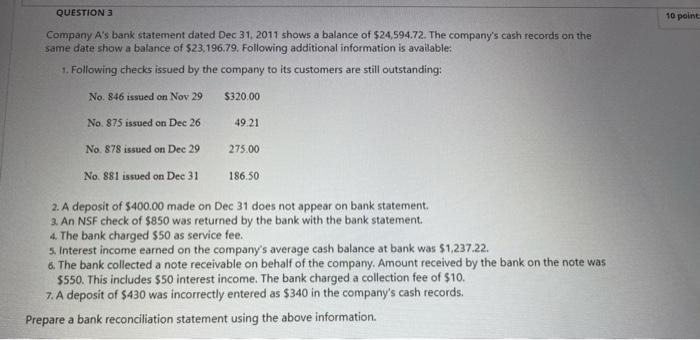

QUESTION 3 10 point Company A's bank statement dated Dec 31, 2011 shows a balance of $24,594.72. The company's cash records on the same date show a balance of $23,196.79. Following additional information is available: 1. Following checks issued by the company to its customers are still outstanding: No. 846 issued on Nov 29 $320.00 No. 875 issued on Dec 26 49.21 275.00 No. 878 issued on Dec 29 No. 881 issued on Dec 31 186.50 2. A deposit of $400.00 made on Dec 31 does not appear on bank statement, 3. An NSF check of $850 was returned by the bank with the bank statement 4. The bank charged $50 as service fee. 5. Interest income earned on the company's average cash balance at bank was $1,237.22. 6. The bank collected a note receivable on behalf of the company. Amount received by the bank on the note was $550. This includes $50 interest income. The bank charged a collection fee of $10. 7. A deposit of $430 was incorrectly entered as $340 in the company's cash records. Prepare a bank reconciliation statement using the above information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts