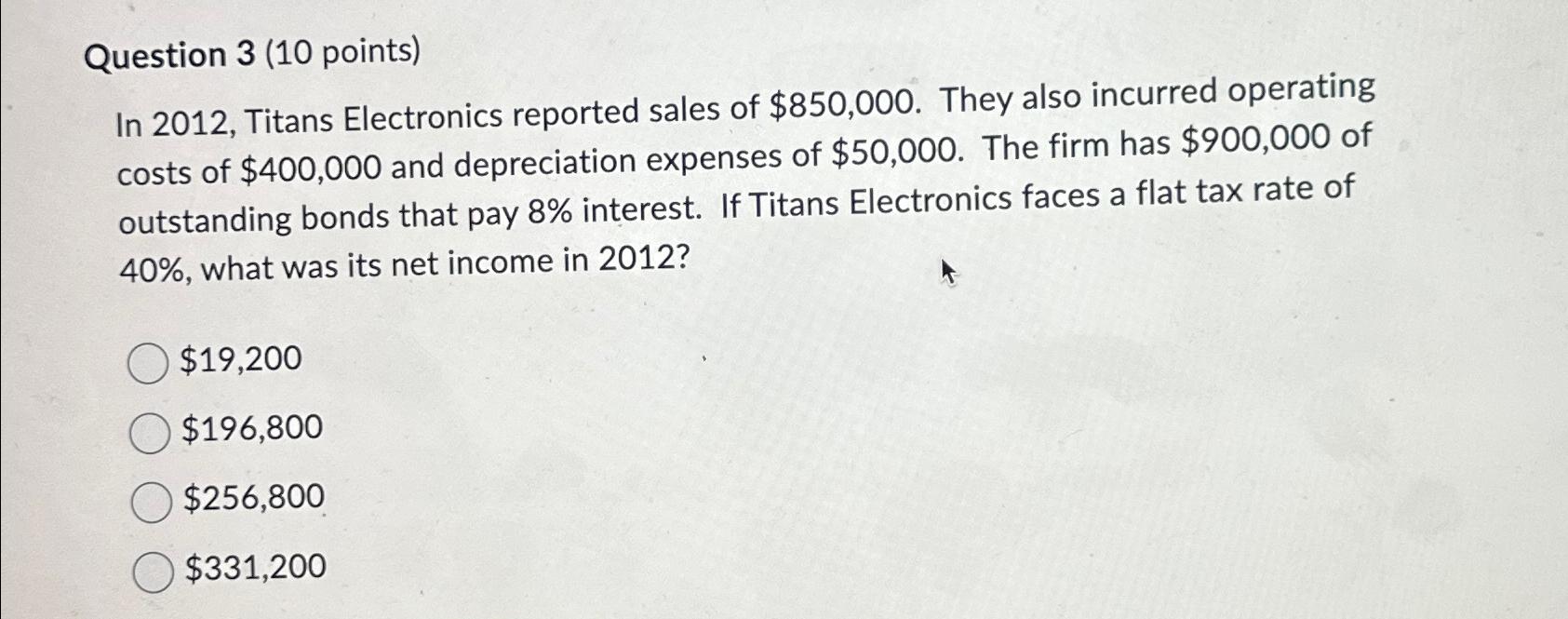

Question: Question 3 (10 points) In 2012, Titans Electronics reported sales of $850,000 . They also incurred operating costs of $400,000 and depreciation expenses of $50,000

Question 3 (10 points)\ In 2012, Titans Electronics reported sales of

$850,000. They also incurred operating costs of

$400,000and depreciation expenses of

$50,000. The firm has

$900,000of outstanding bonds that pay

8%interest. If Titans Electronics faces a flat tax rate of

40%, what was its net income in 2012 ?\

$19,200\

$196,800\

$256,800.\

$331,200

In 2012, Titans Electronics reported sales of $850,000. They also incurred operating costs of $400,000 and depreciation expenses of $50,000. The firm has $900,000 of outstanding bonds that pay 8% interest. If Titans Electronics faces a flat tax rate of 40%, what was its net income in 2012 ? $19,200 $196,800 $256,800 $331,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts