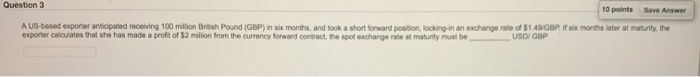

Question: Question 3 10 points Save Answer A US-based exporter anticipated receiving 100 million British Pound (GBP) in six months, and took a short forward to

Question 3 10 points Save Answer A US-based exporter anticipated receiving 100 million British Pound (GBP) in six months, and took a short forward to locking in an exchange rate of $1.40 GBP I six months later at maturity, the exponer calculates that she has made a profit of $2 million from the currency forward contract, the spot exchange rate at maturity must be USD GBP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts