Question: QUESTION 3 10 points Save Answer The financial management team of Discovery Manufacturing is getting ready for its annual account review with is banker. The

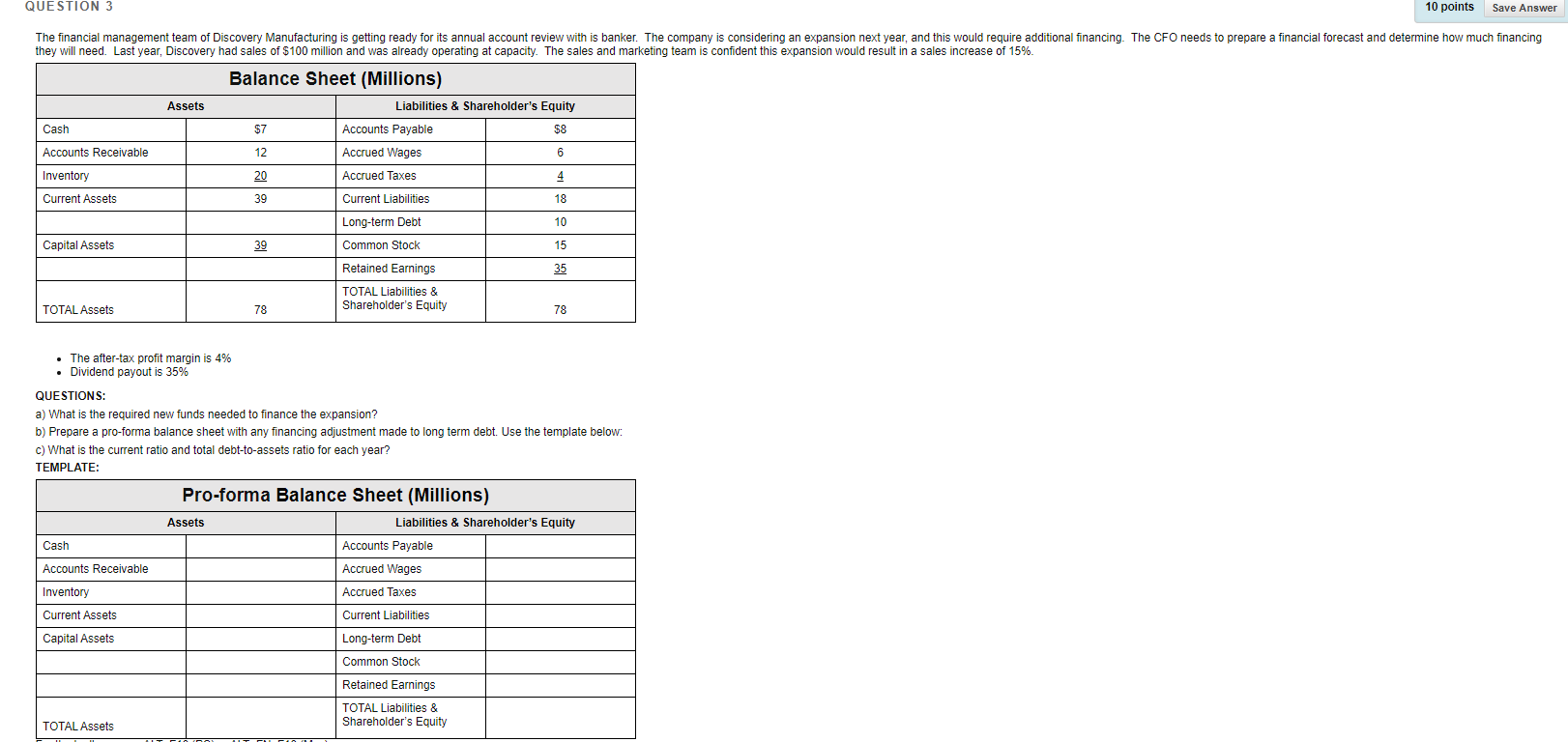

QUESTION 3 10 points Save Answer The financial management team of Discovery Manufacturing is getting ready for its annual account review with is banker. The company is considering an expansion next year, and this would require additional financing. The CFO needs to prepare a financial forecast and determine how much financing they will need. Last year, Discovery had sales of $100 million and was already operating at capacity. The sales and marketing team is confident this expansion would result in a sales increase of 15%. Balance Sheet (Millions) Assets Liabilities & Shareholder's Equity Cash $7 Accounts Payable $8 Accounts Receivable 12 Accrued Wages 6 Inventory 20 Accrued Taxes 4 Current Assets 39 Current Liabilities 18 Long-term Debt 10 Capital Assets 39 Common Stock 15 Retained Earnings 35 TOTAL Liabilities & Shareholder's Equity TOTAL Assets 78 78 The after-tax profit margin is 4% Dividend payout is 35% QUESTIONS: a) What is the required new funds needed to finance the expansion? b) Prepare a pro-forma balance sheet with any financing adjustment made to long term debt. Use the template below: c) What is the current ratio and total debt-to-assets ratio for each year? TEMPLATE: Pro-forma Balance Sheet (Millions) Assets Liabilities & Shareholder's Equity Accounts Payable Accrued Wages Cash Accounts Receivable Inventory Current Assets Accrued Taxes Current Liabilities Long-term Debt Common Stock Capital Assets Retained Earnings TOTAL Liabilities & Shareholder's Equity TOTAL Assets PA QUESTION 3 10 points Save Answer The financial management team of Discovery Manufacturing is getting ready for its annual account review with is banker. The company is considering an expansion next year, and this would require additional financing. The CFO needs to prepare a financial forecast and determine how much financing they will need. Last year, Discovery had sales of $100 million and was already operating at capacity. The sales and marketing team is confident this expansion would result in a sales increase of 15%. Balance Sheet (Millions) Assets Liabilities & Shareholder's Equity Cash $7 Accounts Payable $8 Accounts Receivable 12 Accrued Wages 6 Inventory 20 Accrued Taxes 4 Current Assets 39 Current Liabilities 18 Long-term Debt 10 Capital Assets 39 Common Stock 15 Retained Earnings 35 TOTAL Liabilities & Shareholder's Equity TOTAL Assets 78 78 The after-tax profit margin is 4% Dividend payout is 35% QUESTIONS: a) What is the required new funds needed to finance the expansion? b) Prepare a pro-forma balance sheet with any financing adjustment made to long term debt. Use the template below: c) What is the current ratio and total debt-to-assets ratio for each year? TEMPLATE: Pro-forma Balance Sheet (Millions) Assets Liabilities & Shareholder's Equity Accounts Payable Accrued Wages Cash Accounts Receivable Inventory Current Assets Accrued Taxes Current Liabilities Long-term Debt Common Stock Capital Assets Retained Earnings TOTAL Liabilities & Shareholder's Equity TOTAL Assets PA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts