Question: Question 3 (10 points): Using the Modified Accelerated Cost Recovery method (table A-1), calculate the depreciation of $2,500,000 property for 7-year half -year convention. Note:

Question 3 (10 points):

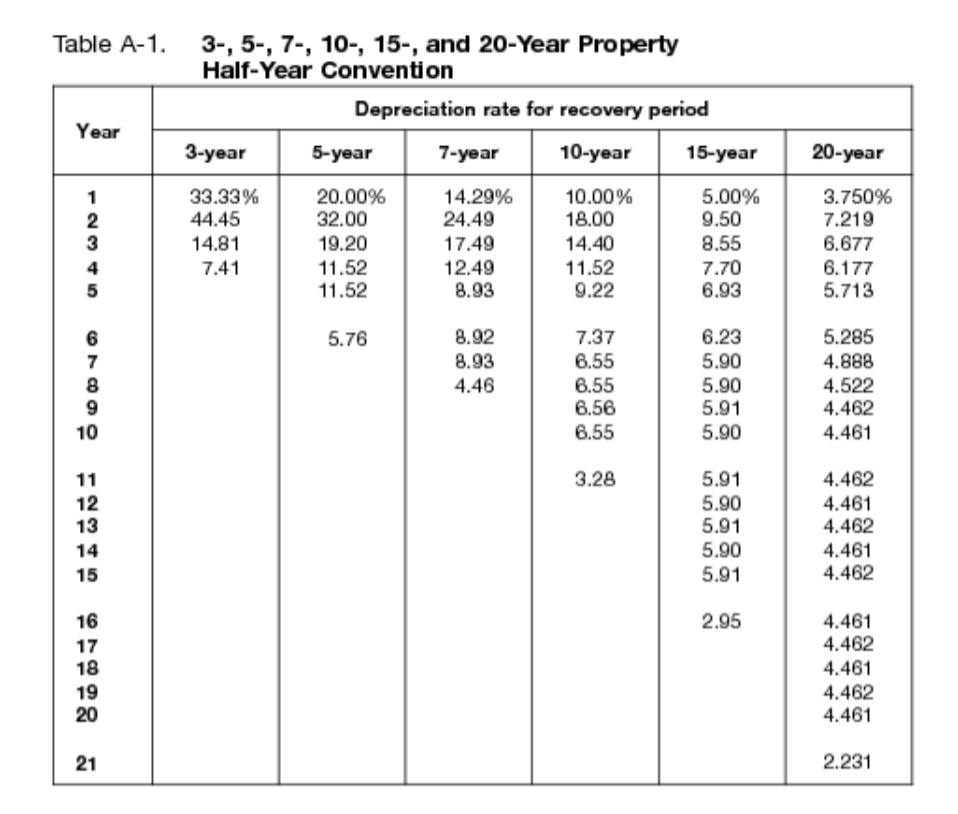

Using the Modified Accelerated Cost Recovery method (table A-1), calculate the depreciation of $2,500,000 property for 7-year half -year convention. Note: you just need to calculate the depreciation; you do not need to use it in any further calculations.

Table A-1. 3-, 5-, 7-, 10-, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period Year 3-year 5-year 7-year 10-year 15-year 20-year 33.33% 44.45 14.81 20.00% 32.00 19.20 11.52 11.52 14.29% 24.49 17.49 12.49 8.93 10.00% 18.00 14.40 11.52 9.22 5.00% 9.50 8.55 7.70 6.93 3.750% 7.219 6.677 6.177 5.713 7.41 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 5.90 5.91 2.95 4.461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts