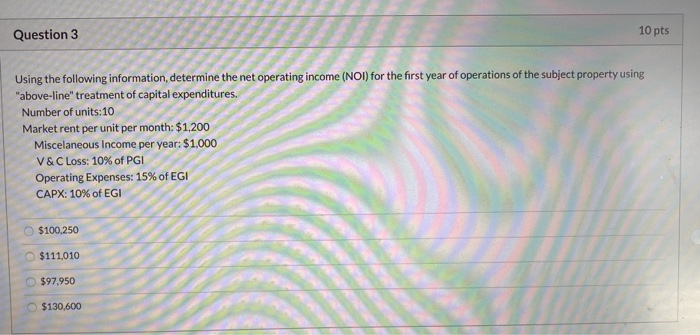

Question: Question 3 10 pts Using the following information determine the net operating income (NOI) for the first year of operations of the subject property using

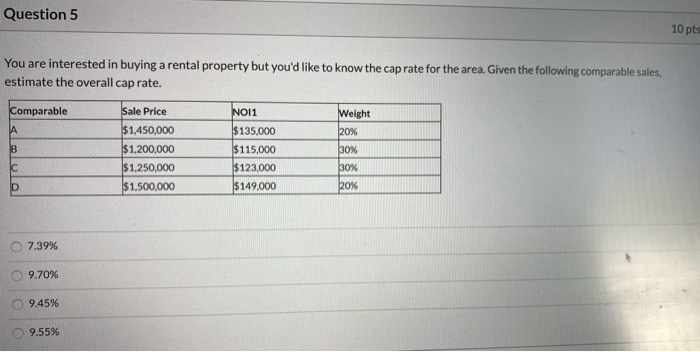

Question 3 10 pts Using the following information determine the net operating income (NOI) for the first year of operations of the subject property using "above-line" treatment of capital expenditures. Number of units:10 Market rent per unit per month: $1,200 Miscelaneous Income per year: $1,000 V&C Loss: 10% of PGI Operating Expenses: 15% of EGI CAPX: 10% of EGI $100.250 $111.010 $97,950 $130,600 Question 5 10 pt You are interested in buying a rental property but you'd like to know the cap rate for the area. Given the following comparable sales, estimate the overall cap rate. Comparable Weight 20% Sale Price $1,450,000 $1,200,000 $1,250,000 $1,500,000 NOI1 $135,000 $115,000 $123,000 $149,000 30% 30% kox 7.39% 9.70% 9.45% 9.55%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts