Question: Question 3. (1000 words maximum, 30 marks in total) a) MM bond is currently priced at discount, 918.89. The bond's par value is 1000. It

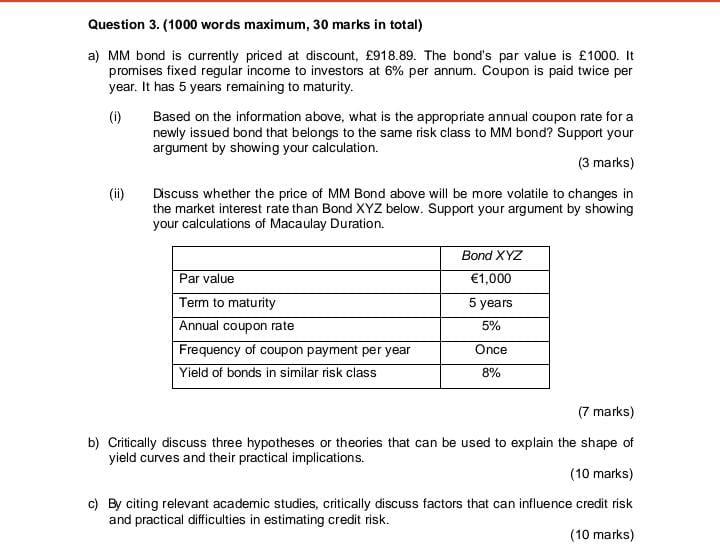

Question 3. (1000 words maximum, 30 marks in total) a) MM bond is currently priced at discount, 918.89. The bond's par value is 1000. It promises fixed regular income to investors at 6% per annum. Coupon is paid twice per year. It has 5 years remaining to maturity. (i) Based on the information above, what is the appropriate annual coupon rate for a newly issued bond that belongs to the same risk class to MM bond? Support your argument by showing your calculation. (3 marks) (ii) Discuss whether the price of MM Bond above will be more volatile to changes in the market interest rate than Bond XYZ below. Support your argument by showing your calculations of Macaulay Duration. (7 marks) b) Critically discuss three hypotheses or theories that can be used to explain the shape of yield curves and their practical implications. (10 marks) c) By citing relevant academic studies, critically discuss factors that can influence credit risk and practical difficulties in estimating credit risk. (10 marks) Question 3. (1000 words maximum, 30 marks in total) a) MM bond is currently priced at discount, 918.89. The bond's par value is 1000. It promises fixed regular income to investors at 6% per annum. Coupon is paid twice per year. It has 5 years remaining to maturity. (i) Based on the information above, what is the appropriate annual coupon rate for a newly issued bond that belongs to the same risk class to MM bond? Support your argument by showing your calculation. (3 marks) (ii) Discuss whether the price of MM Bond above will be more volatile to changes in the market interest rate than Bond XYZ below. Support your argument by showing your calculations of Macaulay Duration. (7 marks) b) Critically discuss three hypotheses or theories that can be used to explain the shape of yield curves and their practical implications. (10 marks) c) By citing relevant academic studies, critically discuss factors that can influence credit risk and practical difficulties in estimating credit risk. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts