Question: Question 3 (11 marks) You learn below from the annual report of ACY THREE Limited: ACY THREE Limited is a professional service provider, listed in

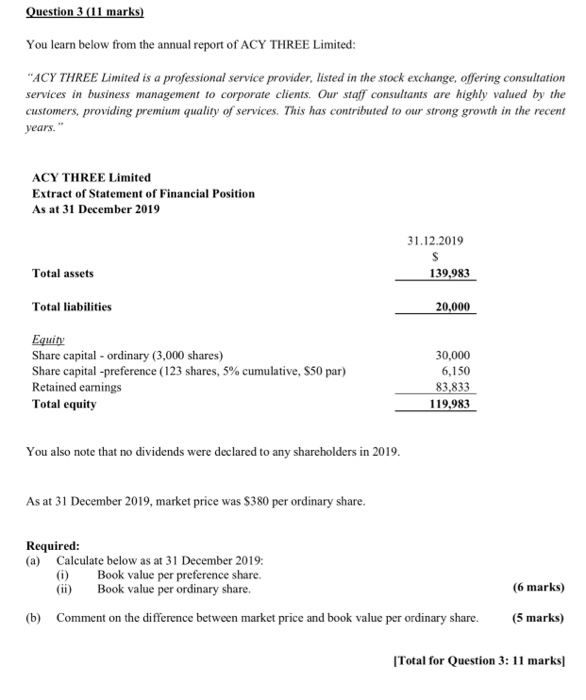

Question 3 (11 marks) You learn below from the annual report of ACY THREE Limited: "ACY THREE Limited is a professional service provider, listed in the stock exchange, offering consultation services in business management to corporate clients. Our staff consultants are highly valued by the customers, providing premium quality of services. This has contributed to our strong growth in the recent years." ACY THREE Limited Extract of Statement of Financial Position As at 31 December 2019 31.12.2019 Total assets 139,983 Total liabilities 20,000 Equity Share capital - ordinary (3,000 shares) Share capital -preference (123 shares, 5% cumulative, S50 par) Retained earnings Total equity 30,000 6,150 83,833 119,983 You also note that no dividends were declared to any shareholders in 2019. As at 31 December 2019, market price was $380 per ordinary share. Required: (a) Calculate below as at 31 December 2019: (i) Book value per preference share. (ii) Book value per ordinary share. (6 marks) (b) Comment on the difference between market price and book value per ordinary share. (5 marks) [Total for Question 3: 11 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts