Question: Question 3 (12 points) (12 Points Total; 4 each). A company just paid a dividend to its common shareholders of $6.60 per share, so DIVO

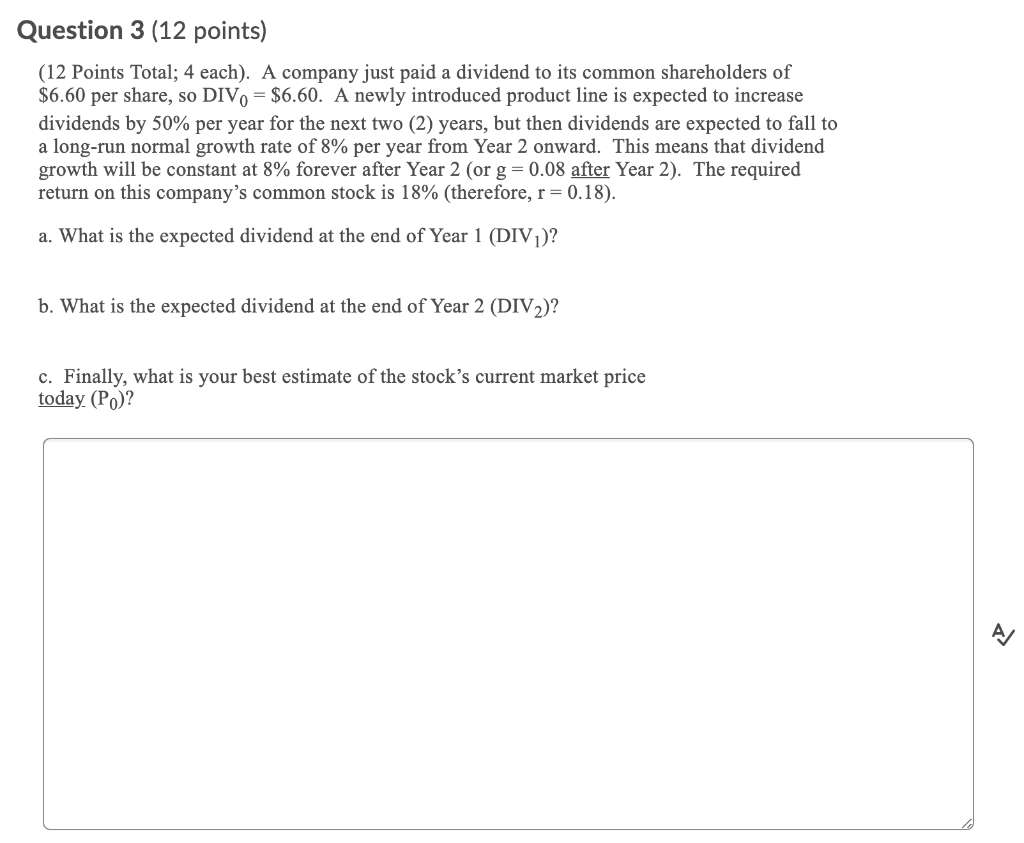

Question 3 (12 points) (12 Points Total; 4 each). A company just paid a dividend to its common shareholders of $6.60 per share, so DIVO = $6.60. A newly introduced product line is expected to increase dividends by 50% per year for the next two (2) years, but then dividends are expected to fall to a long-run normal growth rate of 8% per year from Year 2 onward. This means that dividend growth will be constant at 8% forever after Year 2 (or g = 0.08 after Year 2). The required return on this company's common stock is 18% (therefore, r= 0.18). a. What is the expected dividend at the end of Year 1 (DIV1)? b. What is the expected dividend at the end of Year 2 (DIV)? c. Finally, what is your best estimate of the stock's current market price today. (P.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts