Question: Question 3 (12 points - 6 points for each part) For American companies the FASB issued a new standard that took effect in 2019. It

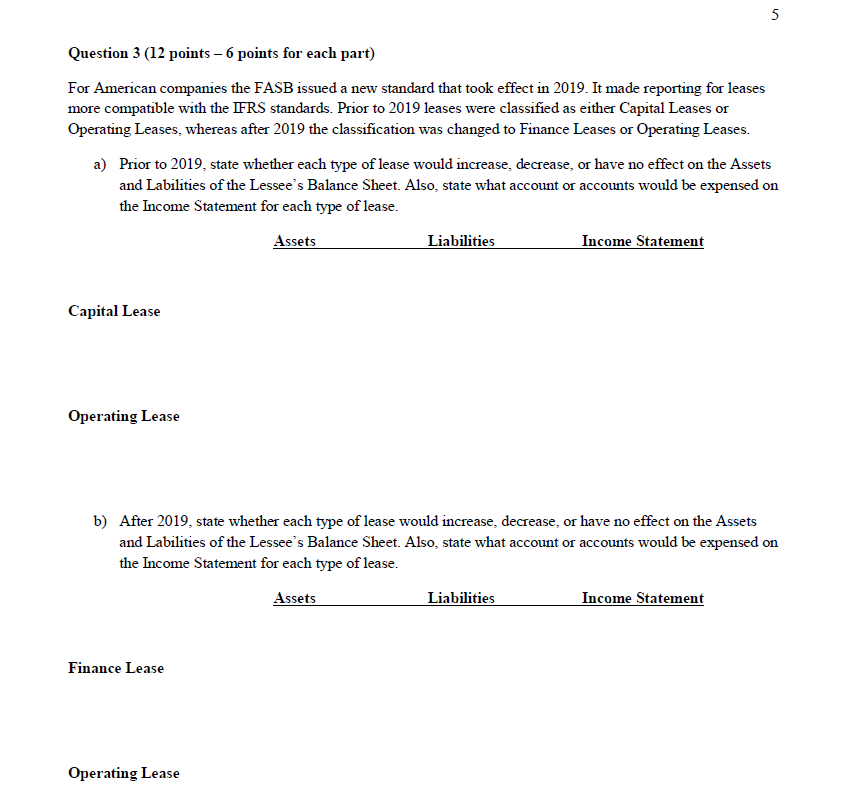

Question 3 (12 points - 6 points for each part) For American companies the FASB issued a new standard that took effect in 2019. It made reporting for leases more compatible with the IFRS standards. Prior to 2019 leases were classified as either Capital Leases or Operating Leases, whereas after 2019 the classification was changed to Finance Leases or Operating Leases. a) Prior to 2019, state whether each type of lease would increase, decrease, or have no effect on the Assets and Labilities of the Lessee's Balance Sheet. Also, state what account or accounts would be expensed on the Income Statement for each type of lease. b) After 2019, state whether each type of lease would increase, decrease, or have no effect on the Assets and Labilities of the Lessee's Balance Sheet. Also, state what account or accounts would be expensed on the Income Statement for each type of lease. Question 3 (12 points - 6 points for each part) For American companies the FASB issued a new standard that took effect in 2019. It made reporting for leases more compatible with the IFRS standards. Prior to 2019 leases were classified as either Capital Leases or Operating Leases, whereas after 2019 the classification was changed to Finance Leases or Operating Leases. a) Prior to 2019, state whether each type of lease would increase, decrease, or have no effect on the Assets and Labilities of the Lessee's Balance Sheet. Also, state what account or accounts would be expensed on the Income Statement for each type of lease. b) After 2019, state whether each type of lease would increase, decrease, or have no effect on the Assets and Labilities of the Lessee's Balance Sheet. Also, state what account or accounts would be expensed on the Income Statement for each type of lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts