Question: Question 3 - (12 points) On December 31, 2019, immediately after making its interest payment, Marion, Inc. called its outstanding $400,000 10% bond at 101.

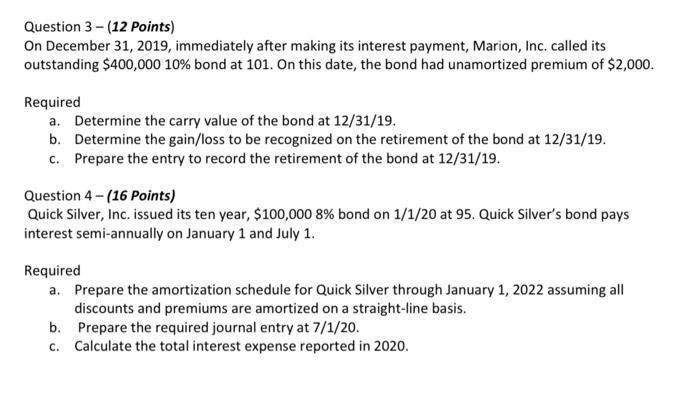

Question 3 - (12 points) On December 31, 2019, immediately after making its interest payment, Marion, Inc. called its outstanding $400,000 10% bond at 101. On this date, the bond had unamortized premium of $2,000. Required a. Determine the carry value of the bond at 12/31/19. b. Determine the gain/loss to be recognized on the retirement of the bond at 12/31/19. C. Prepare the entry to record the retirement of the bond at 12/31/19. Question 4 - (16 points) Quick Silver, Inc. issued its ten year, $100,000 8% bond on 1/1/20 at 95. Quick Silver's bond pays interest semi-annually on January 1 and July 1. Required a. Prepare the amortization schedule for Quick Silver through January 1, 2022 assuming all discounts and premiums are amortized on a straight-line basis. b. Prepare the required journal entry at 7/1/20. C. Calculate the total interest expense reported in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts