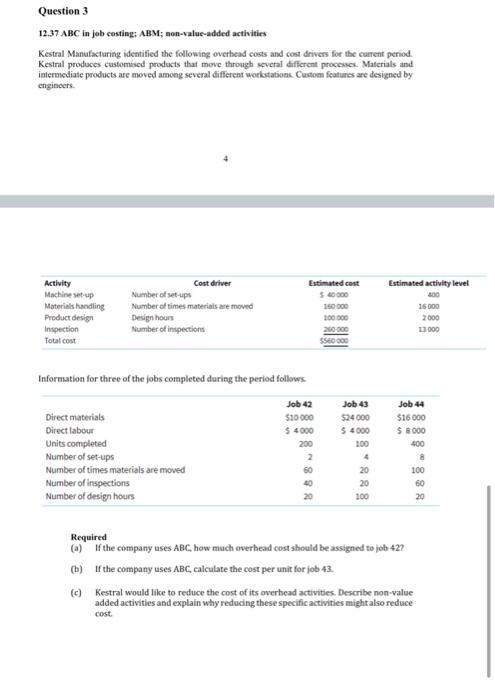

Question: Question 3 12.37 ABC in job cesting; ABM; non-value-added activities Kestral Manufacturing identified the following overhead costs and cost drivers for the current period. Kestral

Question 3 12.37 ABC in job cesting; ABM; non-value-added activities Kestral Manufacturing identified the following overhead costs and cost drivers for the current period. Kestral produces customised products that meve through several different processes. Materials and iatermediate products are moved among several different woekstationk. Custoen features are designed by engineers. 4 Information for three of the jobs completed during the period follows: Required (a) If the company uses ABC, how much overbead cost should be assigned to job 42? (b) If the company uses ABC calculate the cost per unit for job 43. (c) Kestral would like to reduce the cost of its overhead activities. Describe non-value added activities and explain why reducing these specific activities might also reduce cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts