Question: Question 3 --/14 View Policies Current Attempt in Progress Bridgeport Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the

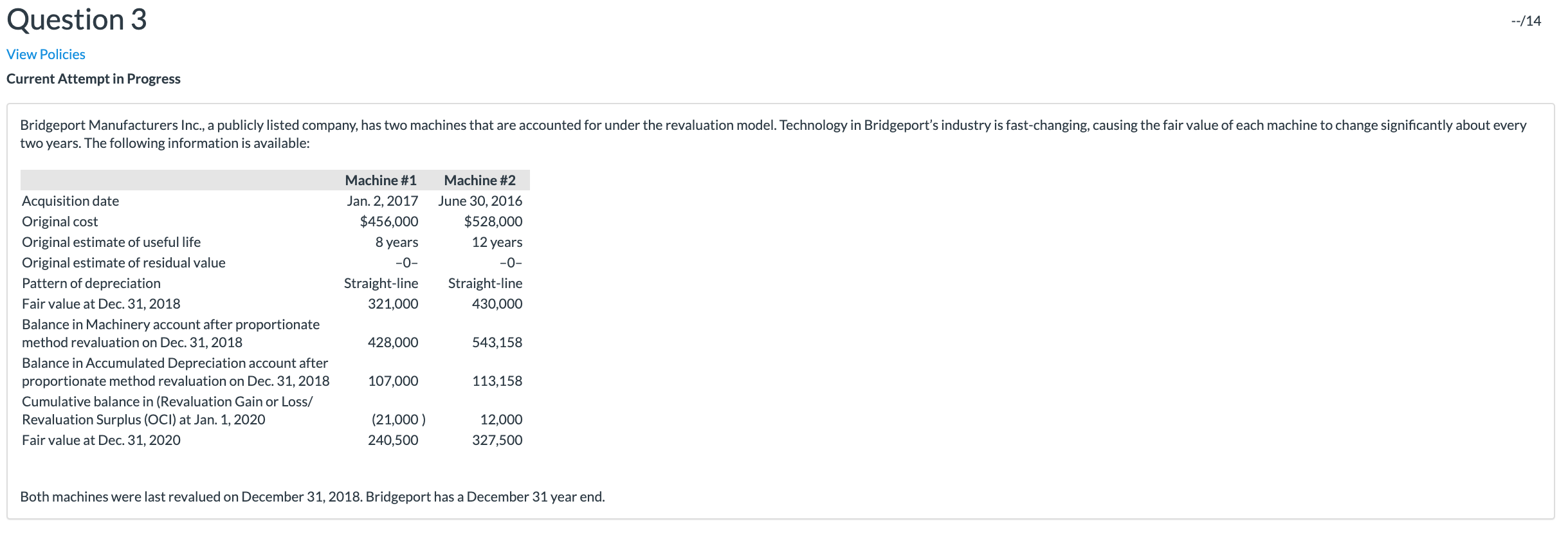

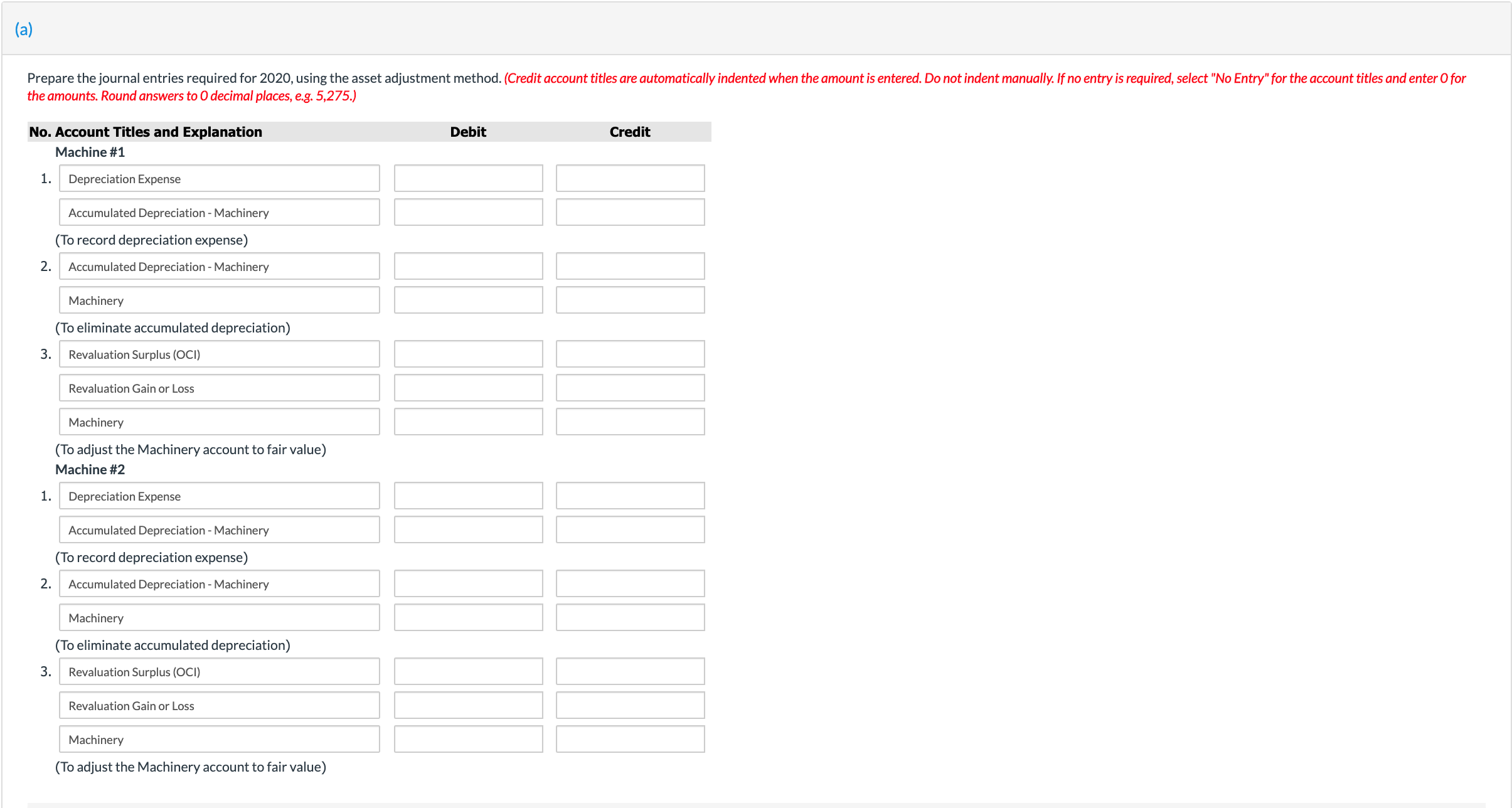

Question 3 --/14 View Policies Current Attempt in Progress Bridgeport Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Bridgeport's industry is fast-changing, causing the fair value of each machine to change significantly about every two years. The following information is available: Machine #1 Machine #2 Acquisition date Jan. 2, 2017 June 30, 2016 Original cost $456,000 $528,000 Original estimate of useful life 8 years 12 years Original estimate of residual value Pattern of depreciation Straight-line Straight-line Fair value at Dec. 31, 2018 321,000 430,000 Balance in Machinery account after proportionate method revaluation on Dec. 31, 2018 428,000 543,158 Balance in Accumulated Depreciation account after proportionate method revaluation on Dec. 31, 2018 107,000 113,158 Cumulative balance in (Revaluation Gain or Loss/ Revaluation Surplus (OCI) at Jan. 1, 2020 (21,000 ) 12,000 Fair value at Dec. 31, 2020 240,500 327,500 Both machines were last revalued on December 31, 2018. Bridgeport has a December 31 year end.(a) Prepare the journal entries required for 2020, using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,275.) No. Account Titles and Explanation Debit Credit Machine #1 1. Depreciation Expense Accumulated Depreciation - Machinery (To record depreciation expense) 2. Accumulated Depreciation - Machinery Machinery (To eliminate accumulated depreciation) 3. Revaluation Surplus (OCI) Revaluation Gain or Loss Machinery (To adjust the Machinery account to fair value) Machine #2 1. Depreciation Expense Accumulated Depreciation - Machinery (To record depreciation expense) 2. Accumulated Depreciation - Machinery Machinery (To eliminate accumulated depreciation) 3. Revaluation Surplus (OCI) Revaluation Gain or Loss Machinery (To adjust the Machinery account to fair value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts