Question: Question 3 (15 marks) a) Target Stores is a retail firm with no debt outstanding. However, the firm does have operating lease commitments of $

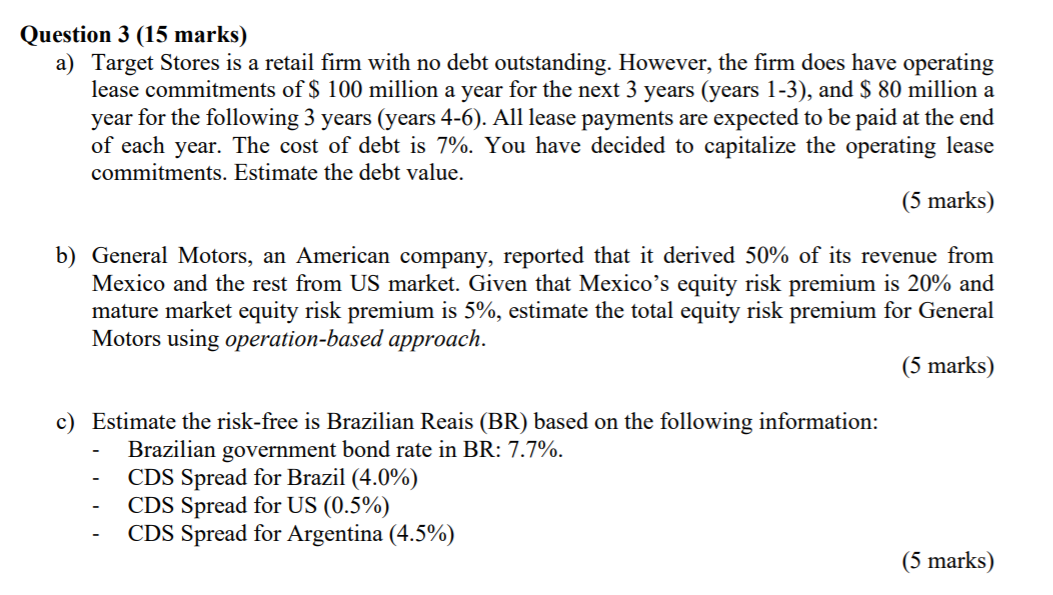

Question 3 (15 marks) a) Target Stores is a retail firm with no debt outstanding. However, the firm does have operating lease commitments of $ 100 million a year for the next 3 years (years 1-3), and $ 80 million a year for the following 3 years (years 4-6). All lease payments are expected to be paid at the end of each year. The cost of debt is 7%. You have decided to capitalize the operating lease commitments. Estimate the debt value. (5 marks) b) General Motors, an American company, reported that it derived 50% of its revenue from Mexico and the rest from US market. Given that Mexico's equity risk premium is 20% and mature market equity risk premium is 5%, estimate the total equity risk premium for General Motors using operation-based approach. (5 marks) c) Est Estimate the risk-free is Brazilian Reais (BR) based on the following information: - Brazilian government bond rate in BR: 7.7%. - CDS Spread for Brazil (4.0%) - CDS Spread for US (0.5%) CDS Spread for Argentina (4.5%) (5 marks) Question 3 (15 marks) a) Target Stores is a retail firm with no debt outstanding. However, the firm does have operating lease commitments of $ 100 million a year for the next 3 years (years 1-3), and $ 80 million a year for the following 3 years (years 4-6). All lease payments are expected to be paid at the end of each year. The cost of debt is 7%. You have decided to capitalize the operating lease commitments. Estimate the debt value. (5 marks) b) General Motors, an American company, reported that it derived 50% of its revenue from Mexico and the rest from US market. Given that Mexico's equity risk premium is 20% and mature market equity risk premium is 5%, estimate the total equity risk premium for General Motors using operation-based approach. (5 marks) c) Est Estimate the risk-free is Brazilian Reais (BR) based on the following information: - Brazilian government bond rate in BR: 7.7%. - CDS Spread for Brazil (4.0%) - CDS Spread for US (0.5%) CDS Spread for Argentina (4.5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts