Question: QUESTION 3 (15 marks) Part I (12 marks) Ripken Company uses a perpetual inventory system and reported the following transactions involving inventory during the month

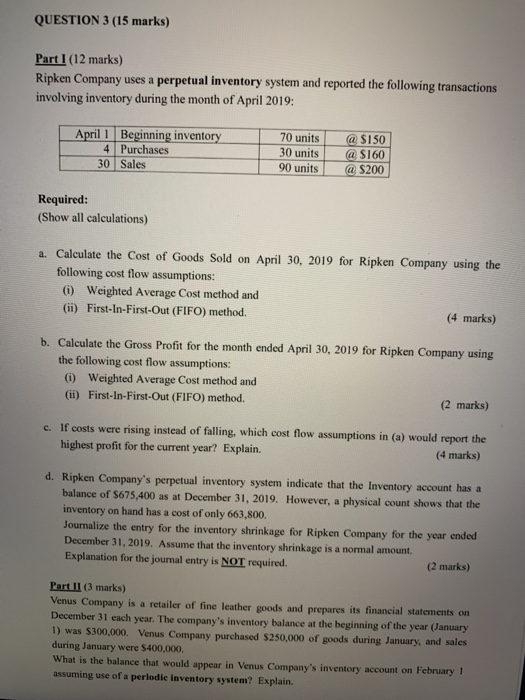

QUESTION 3 (15 marks) Part I (12 marks) Ripken Company uses a perpetual inventory system and reported the following transactions involving inventory during the month of April 2019: April 1 Beginning inventory 4 Purchases 30 Sales 70 units 30 units 90 units @ $150 @ $160 a $200 Required: (Show all calculations) a. Calculate the cost of Goods Sold on April 30, 2019 for Ripken Company using the following cost flow assumptions: (1) Weighted Average Cost method and (ii) First-In-First-Out (FIFO) method. (4 marks) b. Calculate the Gross Profit for the month ended April 30, 2019 for Ripken Company using the following cost flow assumptions: (1) Weighted Average Cost method and (ii) First-In-First-Out (FIFO) method. (2 marks) c. If costs were rising instead of falling, which cost flow assumptions in (a) would report the highest profit for the current year? Explain. (4 marks) d. Ripken Company's perpetual inventory system indicate that the Inventory account has a balance of $675,400 as at December 31, 2019. However, a physical count shows that the inventory on hand has a cost of only 663,800. Journalize the entry for the inventory shrinkage for Ripken Company for the year ended December 31, 2019. Assume that the inventory shrinkage is a normal amount. Explanation for the journal entry is NOT required. (2 marks) Part II (3 marks) Venus Company is a retailer of fine leather goods and prepares its financial statements on December 31 each year. The company's inventory balance at the beginning of the year (January 1) was $300,000. Venus Company purchased $250,000 of goods during January, and sales during January were $400,000. What is the balance that would appear in Venus Company's inventory account on February 1 assuming use of a periodie Inventory system? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts