Question: Question 3 (15 marks). Professor Bob is designing an experiment to test if the Nash bargaining solution accurately predicts the behaviour of real decision

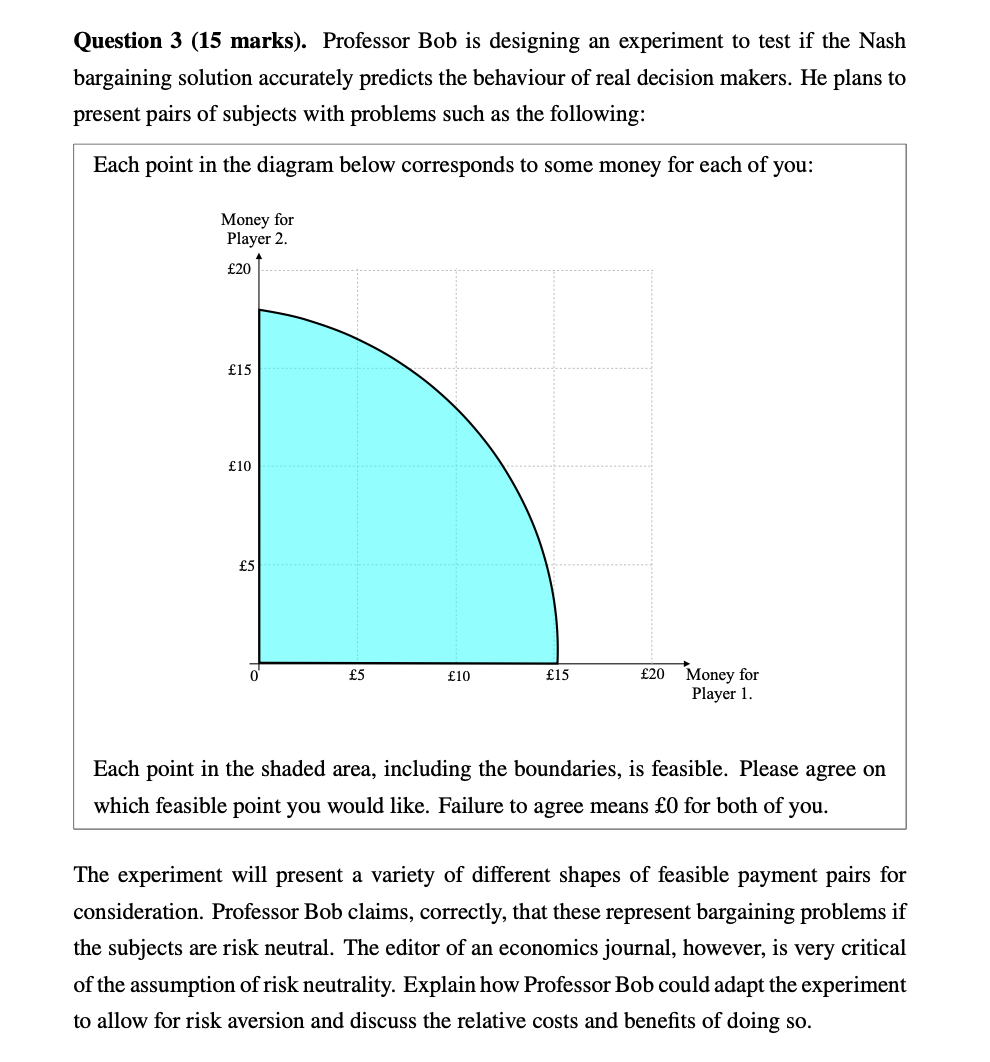

Question 3 (15 marks). Professor Bob is designing an experiment to test if the Nash bargaining solution accurately predicts the behaviour of real decision makers. He plans to present pairs of subjects with problems such as the following: Each point in the diagram below corresponds to some money for each of you: Money for Player 2. 20 15 10 5 0 5 10 15 20 Money for Player 1. Each point in the shaded area, including the boundaries, is feasible. Please agree on which feasible point you would like. Failure to agree means 0 for both of you. The experiment will present a variety of different shapes of feasible payment pairs for consideration. Professor Bob claims, correctly, that these represent bargaining problems if the subjects are risk neutral. The editor of an economics journal, however, is very critical of the assumption of risk neutrality. Explain how Professor Bob could adapt the experiment to allow for risk aversion and discuss the relative costs and benefits of doing so.

Step by Step Solution

3.31 Rating (142 Votes )

There are 3 Steps involved in it

To adapt the experiment to allow for risk aversion Professor Bob can introduce a lottery element to the feasible payment pairs Instead of presenting a ... View full answer

Get step-by-step solutions from verified subject matter experts