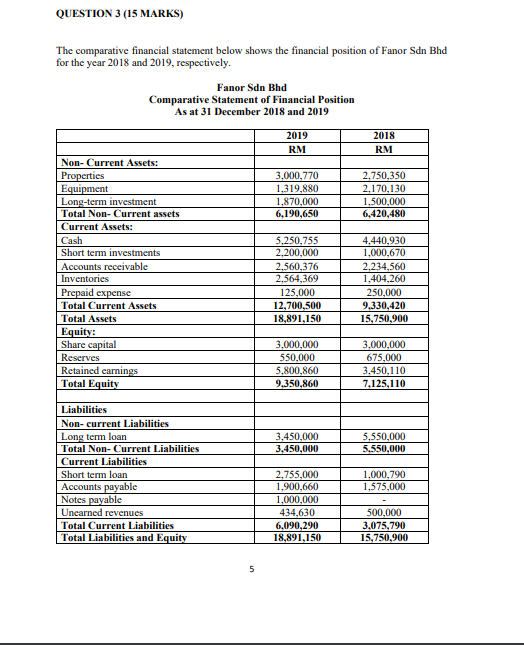

Question: QUESTION 3 (15 MARKS) The comparative financial statement below shows the financial position of Fanor Sdn Bhd for the year 2018 and 2019, respectively. Fanor

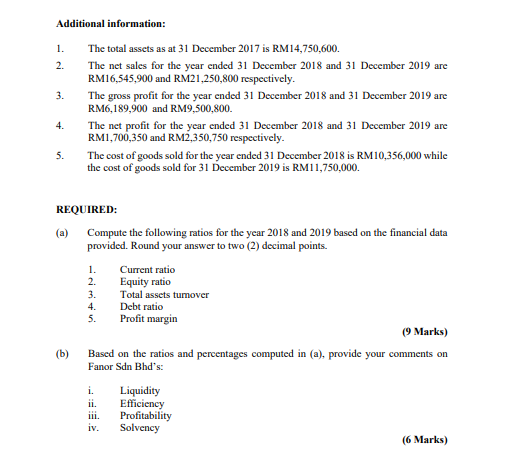

QUESTION 3 (15 MARKS) The comparative financial statement below shows the financial position of Fanor Sdn Bhd for the year 2018 and 2019, respectively. Fanor Sdn Bhd Comparative Statement of Financial Position As at 31 December 2018 and 2019 2019 RM 2018 RM 3,000,770 1.319,880 1,870,000 6,190,650 2.750,350 2,170,130 1,500,000 6,420,480 Non-Current Assets: Properties Equipment Long-term investment Total Non-Current assets Current Assets: Cash Short term investments Accounts receivable Inventories Prepaid expense Total Current Assets Total Assets Equity: Share capital Reserves Retained earnings Total Equity 5,250,755 2,200,000 2,560,376 2,564,369 125,000 12,700,500 18,891,150 4,440,930 1,000,670 2.234,560 1,404,260 250,000 9.330,420 15,750,900 3,000,000 550,000 5.800,860 9.350,860 3,000,000 675,000 3,450,110 7,125,110 3.450,000 3.450,000 5,550,000 5.550.000 Liabilities Non-current Liabilities Long term loan Total Non-Current Liabilities Current Liabilities Short term loan Accounts payable Notes payable Unearned revenues Total Current Liabilities Total Liabilities and Equity 1,000,790 1,575,000 2.755,000 1,900,660 1.000.000 434,630 6,090,290 18,891,150 500,000 3,075,790 15,750,900 5 Additional information: 1. 2. 3. The total assets as at 31 December 2017 is RM14,750,600. The net sales for the year ended 31 December 2018 and 31 December 2019 are RM16,545,900 and RM21,250,800 respectively. The gross profit for the year ended 31 December 2018 and 31 December 2019 are RM6,189,900 and RM9.500,800. The net profit for the year ended 31 December 2018 and 31 December 2019 are RM1,700,350 and RM2,350,750 respectively. The cost of goods sold for the year ended 31 December 2018 is RM10,356,000 while the cost of goods sold for 31 December 2019 is RM11,750,000. 4. 5. REQUIRED: (a) Compute the following ratios for the year 2018 and 2019 based on the financial data provided. Round your answer to two (2) decimal points. 1. Current ratio 2. Equity ratio 3. Total assets tumover 4. Debt ratio 5. Profit margin (9 Marks) (b) Based on the ratios and percentages computed in (a), provide your comments on Fanor Sdn Bhd's: i. Liquidity ii. Efficiency Profitability iv. Solvency (6 Marks) ili

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts