Question: Question 3 (15 marks) This question consists of two separate parts. Part A (11 marks) Presented below are selected transactions for Watts Ltd for the

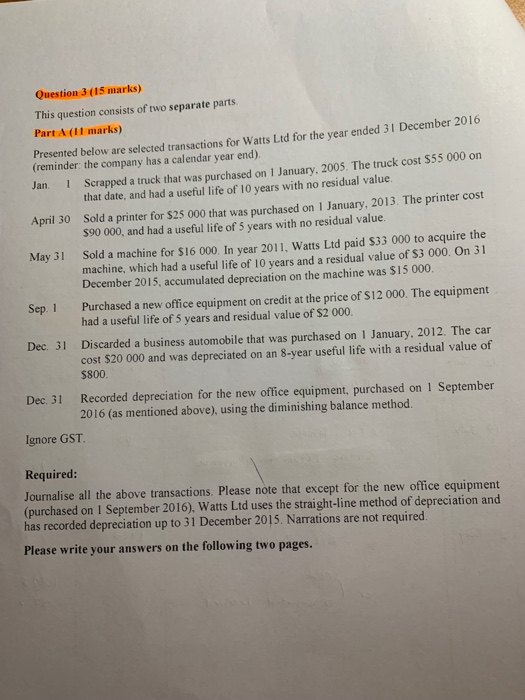

Question 3 (15 marks) This question consists of two separate parts. Part A (11 marks) Presented below are selected transactions for Watts Ltd for the vear ended 31 December 2016 (reminder: the company has a calendar year end). 1 Scrapped a truck that was that date, and had a useful life of 10 vears with no residual value. purchased on 1 January, 2005. The truck cost $55 000 on Jan Sold a printer for $25 000 that was purchased on 1 January, 2013. The printer cost $90 000, and had a useful life of 5 years with no residual value. April 30 Sold a machine for $16 000. In vear 2011, Watts Ltd paid S33 000 to acquire the machine, which had a useful life of 10 years and a residual value of $3 000. On 31 December 2015, accumulated depreciation on the machine was $15 000. May 31 Purchased a new office equipment on credit at the price of $12 000. The equipment had a useful life of 5 years and residual value of $2 000. Sep. 1 Discarded a business automobile that was cost $20 000 and was depreciated on an Dec. 31 purchased 8-year useful life with a residual value of on 1 January, 2012. The car $800. Recorded depreciation for the new office equipment, purchased 2016 (as mentioned above), using the diminishing balance method. Dec. 31 on 1 September Ignore GST Required: Journalise all the above transactions. Please note that except for the new office equipment (purchased on 1 September 2016), Watts Ltd uses the straight-line method of depreciation and has recorded depreciation up to 31 December 2015. Narrations are not required. Please write your answer: ers on the following two pages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts