Question: Question 3 15pts Problem 2: Determine AGI During 2022 Carl Spackler, a single taxpayer with no dependents, reported the following information: Receipts Wages from his

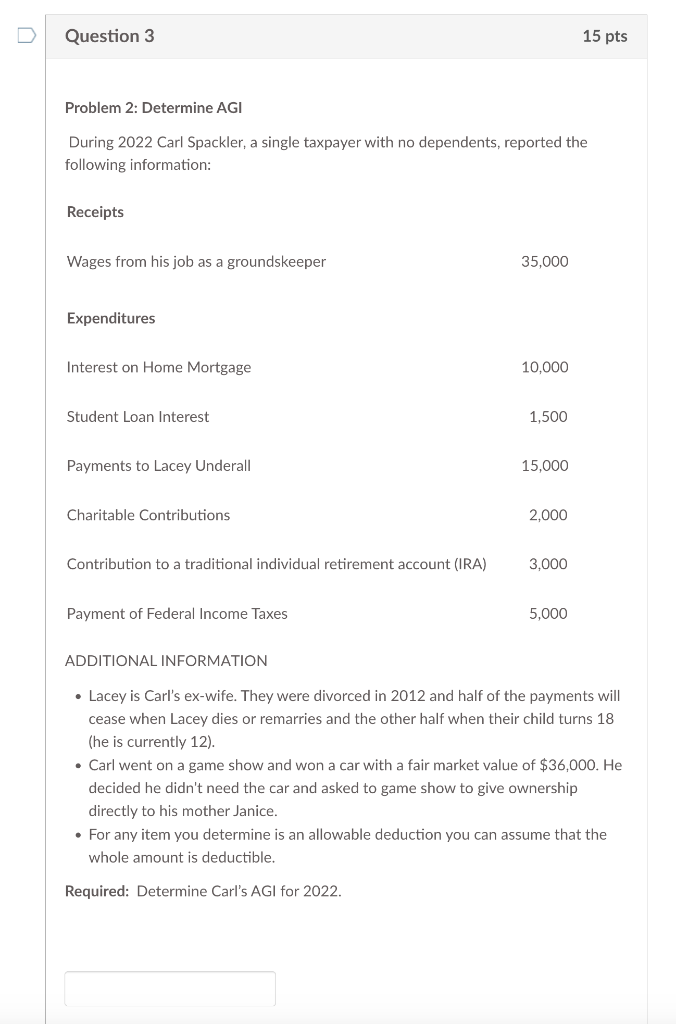

Question 3 15pts Problem 2: Determine AGI During 2022 Carl Spackler, a single taxpayer with no dependents, reported the following information: Receipts Wages from his job as a groundskeeper 35,000 Expenditures Interest on Home Mortgage 10,000 Student Loan Interest 1,500 Payments to Lacey Underall 15,000 Charitable Contributions 2,000 Contribution to a traditional individual retirement account (IRA) 3,000 Payment of Federal Income Taxes 5,000 ADDITIONAL INFORMATION - Lacey is Carl's ex-wife. They were divorced in 2012 and half of the payments will cease when Lacey dies or remarries and the other half when their child turns 18 (he is currently 12). - Carl went on a game show and won a car with a fair market value of $36,000. He decided he didn't need the car and asked to game show to give ownership directly to his mother Janice. - For any item you determine is an allowable deduction you can assume that the whole amount is deductible. Required: Determine Carl's AGI for 2022. Question 3 15pts Problem 2: Determine AGI During 2022 Carl Spackler, a single taxpayer with no dependents, reported the following information: Receipts Wages from his job as a groundskeeper 35,000 Expenditures Interest on Home Mortgage 10,000 Student Loan Interest 1,500 Payments to Lacey Underall 15,000 Charitable Contributions 2,000 Contribution to a traditional individual retirement account (IRA) 3,000 Payment of Federal Income Taxes 5,000 ADDITIONAL INFORMATION - Lacey is Carl's ex-wife. They were divorced in 2012 and half of the payments will cease when Lacey dies or remarries and the other half when their child turns 18 (he is currently 12). - Carl went on a game show and won a car with a fair market value of $36,000. He decided he didn't need the car and asked to game show to give ownership directly to his mother Janice. - For any item you determine is an allowable deduction you can assume that the whole amount is deductible. Required: Determine Carl's AGI for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts