Question: Question 3 [16 points) Suppose an agent has $100. He opens a demand deposit of $100 with a bank which has asset x where x

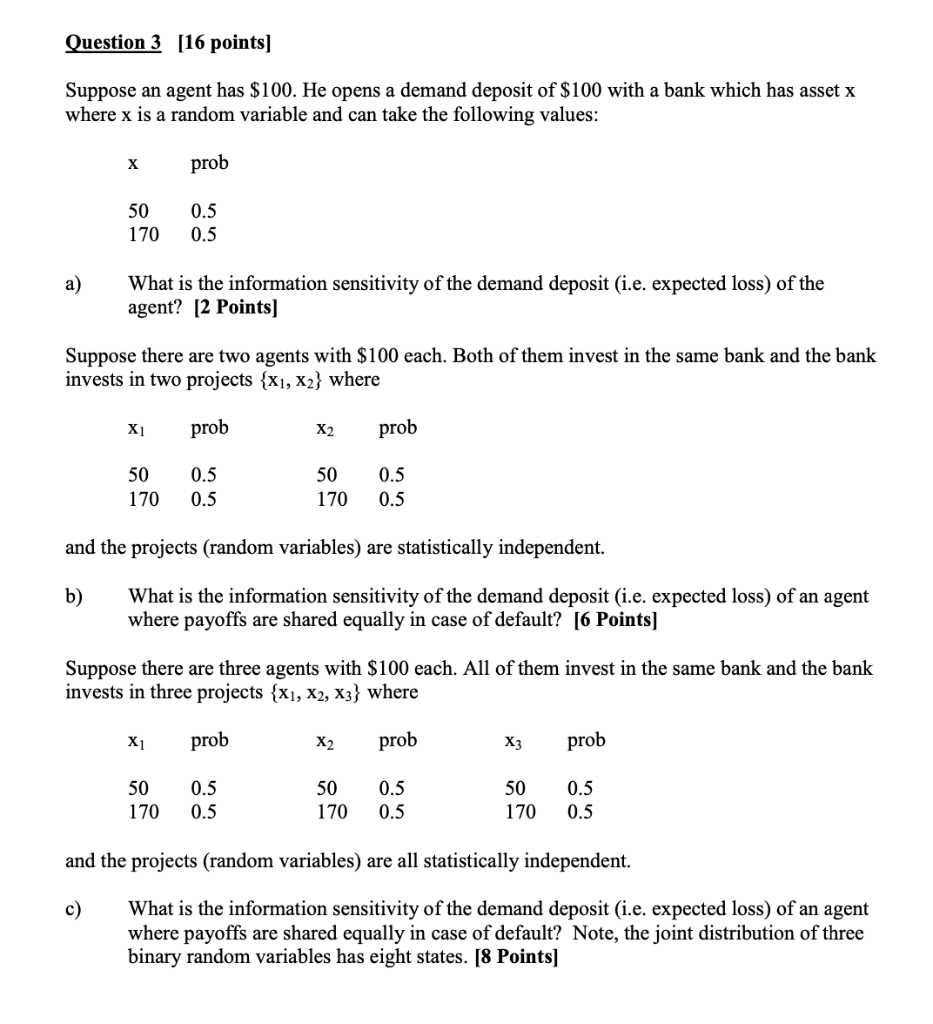

Question 3 [16 points) Suppose an agent has $100. He opens a demand deposit of $100 with a bank which has asset x where x is a random variable and can take the following values: X prob 50 170 0.5 0.5 a) What is the information sensitivity of the demand deposit (i.e. expected loss) of the agent? [2 Points] Suppose there are two agents with $100 each. Both of them invest in the same bank and the bank invests in two projects {x1, X2} where X1 prob X2 prob 50 170 0.5 0.5 50 170 0.5 0.5 and the projects (random variables) are statistically independent. b) What is the information sensitivity of the demand deposit (i.e. expected loss) of an agent where payoffs are shared equally in case of default? [6 Points] Suppose there are three agents with $100 each. All of them invest in the same bank and the bank invests in three projects {X1, X2, X3} where X1 prob X2 prob X3 prob 50 170 0.5 0.5 50 170 0.5 0.5 50 170 0.5 0.5 and the projects (random variables) are all statistically independent. c) What is the information sensitivity of the demand deposit (i.e. expected loss) of an agent where payoffs are shared equally in case of default? Note, the joint distribution of three binary random variables has eight states. [8 Points] Question 3 [16 points) Suppose an agent has $100. He opens a demand deposit of $100 with a bank which has asset x where x is a random variable and can take the following values: X prob 50 170 0.5 0.5 a) What is the information sensitivity of the demand deposit (i.e. expected loss) of the agent? [2 Points] Suppose there are two agents with $100 each. Both of them invest in the same bank and the bank invests in two projects {x1, X2} where X1 prob X2 prob 50 170 0.5 0.5 50 170 0.5 0.5 and the projects (random variables) are statistically independent. b) What is the information sensitivity of the demand deposit (i.e. expected loss) of an agent where payoffs are shared equally in case of default? [6 Points] Suppose there are three agents with $100 each. All of them invest in the same bank and the bank invests in three projects {X1, X2, X3} where X1 prob X2 prob X3 prob 50 170 0.5 0.5 50 170 0.5 0.5 50 170 0.5 0.5 and the projects (random variables) are all statistically independent. c) What is the information sensitivity of the demand deposit (i.e. expected loss) of an agent where payoffs are shared equally in case of default? Note, the joint distribution of three binary random variables has eight states. [8 Points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts