Question: Question 3 (16 points) You are considering the following two stocks for your investment portfolio. Stock X has a beta of 0.8, and the expected

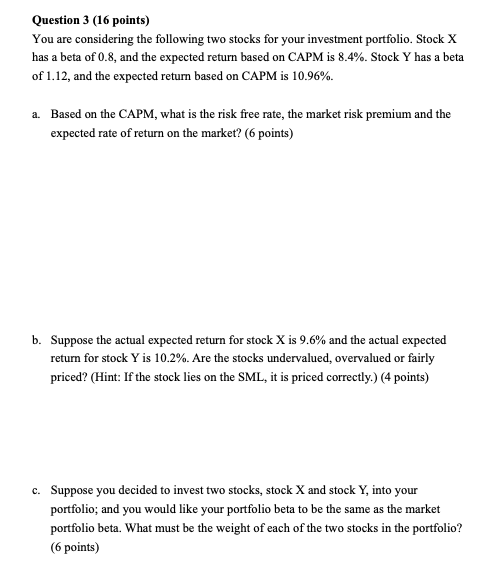

Question 3 (16 points) You are considering the following two stocks for your investment portfolio. Stock X has a beta of 0.8, and the expected return based on CAPM is 8.4%. Stock Y has a beta of 1.12, and the expected return based on CAPM is 10.96%. a. Based on the CAPM, what is the risk free rate, the market risk premium and the expected rate of return on the market? (6 points) b. Suppose the actual expected return for stock X is 9.6% and the actual expected return for stock Y is 10.2%. Are the stocks undervalued, overvalued or fairly priced? (Hint: If the stock lies on the SML, it is priced correctly.) (4 points) c. Suppose you decided to invest two stocks, stock X and stock Y, into your portfolio; and you would like your portfolio beta to be the same as the market portfolio beta. What must be the weight of each of the two stocks in the portfolio? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts