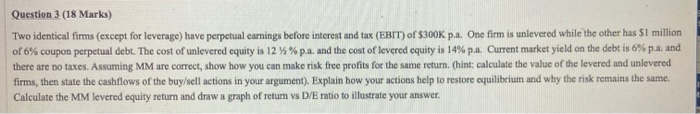

Question: Question 3 (18 Marks) Two identical firms (except for leverage) have perpetual carnings before interest and tax (EBIT) of $300K P... One firm is unlevered

Question 3 (18 Marks) Two identical firms (except for leverage) have perpetual carnings before interest and tax (EBIT) of $300K P... One firm is unlevered while the other has $1 million of 6% coupon perpetual debt. The cost of unlevered equity is 12 %%p... and the cost of levered equity is 14% pa. Current market yield on the debt is 6% pa, and there are no taxes. Assuming MM are correct, show how you can make risk free profits for the same return. (hint: calculate the value of the levered and unlevered firms, then state the cashflows of the buy/sell actions in your argument). Explain how your actions help to restore equilibrium and why the risk remains the same. Calculate the MM levered equity return and draw a graph of return vs D/E ratio to illustrate your answer. Question 3 (18 Marks) Two identical firms (except for leverage) have perpetual carnings before interest and tax (EBIT) of $300K P... One firm is unlevered while the other has $1 million of 6% coupon perpetual debt. The cost of unlevered equity is 12 %%p... and the cost of levered equity is 14% pa. Current market yield on the debt is 6% pa, and there are no taxes. Assuming MM are correct, show how you can make risk free profits for the same return. (hint: calculate the value of the levered and unlevered firms, then state the cashflows of the buy/sell actions in your argument). Explain how your actions help to restore equilibrium and why the risk remains the same. Calculate the MM levered equity return and draw a graph of return vs D/E ratio to illustrate your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts