Question: Question 3 (18 Points): Consider an economy with two dates (t=0,1) and three stocks. There are 3 states at t=1. The stocks' state contingent payoffs

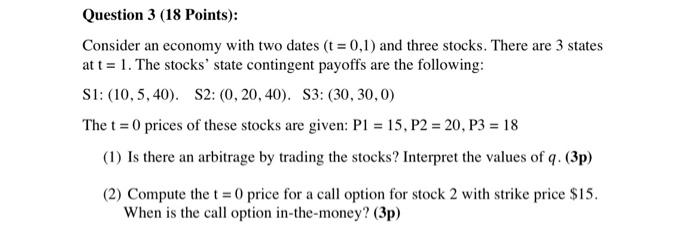

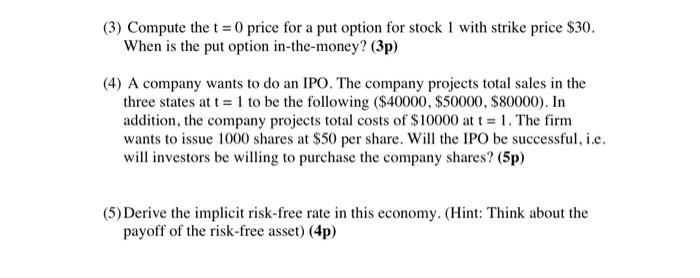

Question 3 (18 Points): Consider an economy with two dates (t=0,1) and three stocks. There are 3 states at t=1. The stocks' state contingent payoffs are the following: S1: (10,5,40). S2: (0,20,40). S3: (30,30,0) The t=0 prices of these stocks are given: P1=15,P2=20,P3=18 (1) Is there an arbitrage by trading the stocks? Interpret the values of q. (3p) (2) Compute the t=0 price for a call option for stock 2 with strike price $15. When is the call option in-the-money? (3p) (3) Compute the t=0 price for a put option for stock 1 with strike price $30. When is the put option in-the-money? (3p) (4) A company wants to do an IPO. The company projects total sales in the three states at t=1 to be the following $40000,$50000,$80000). In addition, the company projects total costs of $10000 at t=1. The firm wants to issue 1000 shares at $50 per share. Will the IPO be successful, i.e. will investors be willing to purchase the company shares? (5p) (5) Derive the implicit risk-free rate in this economy. (Hint: Think about the payoff of the risk-free asset) (4p)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts