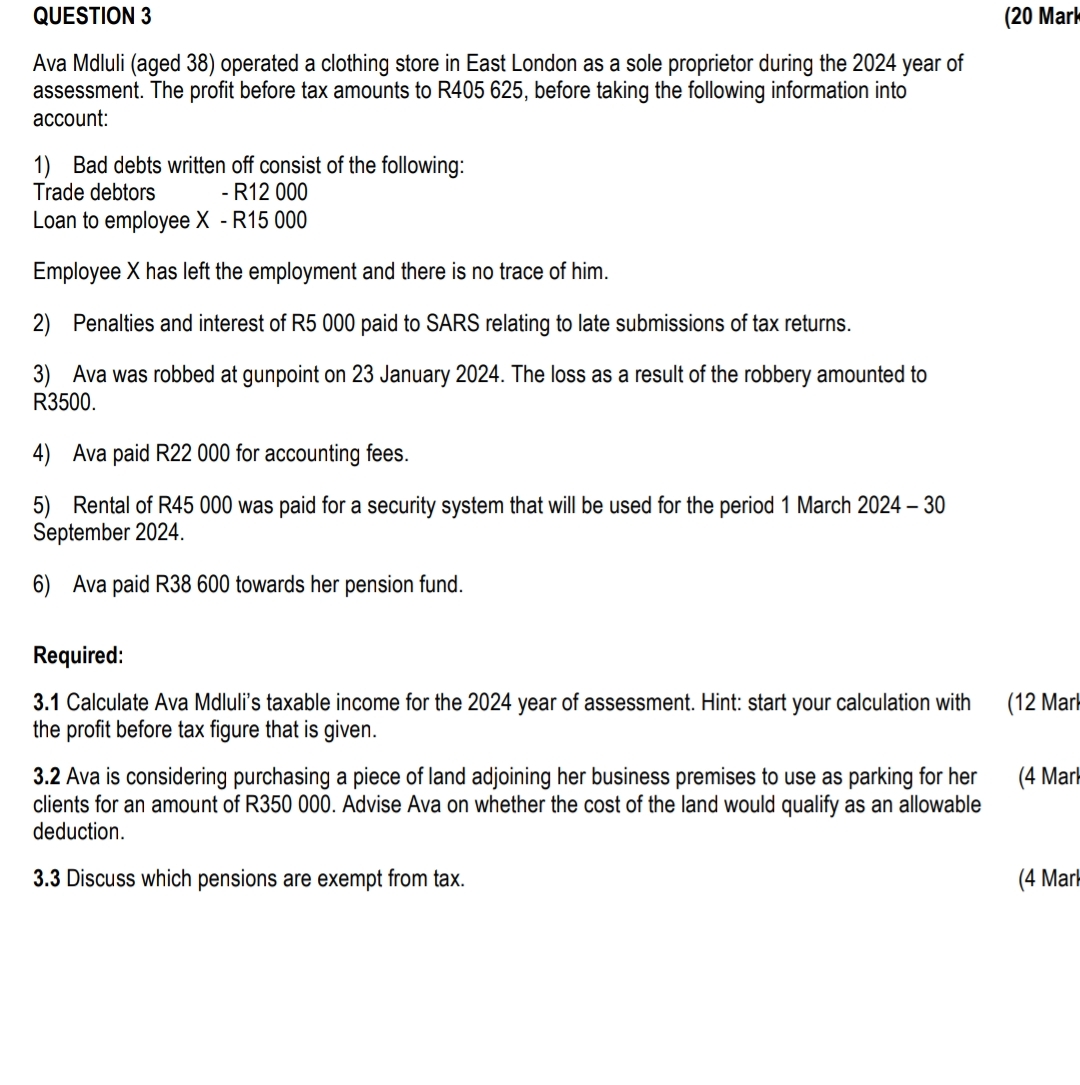

Question: QUESTION 3 ( 2 0 Mark Ava Mdluli ( aged 3 8 ) operated a clothing store in East London as a sole proprietor during

QUESTION

Mark

Ava Mdluli aged operated a clothing store in East London as a sole proprietor during the year of assessment. The profit before tax amounts to R before taking the following information into account:

Bad debts written off consist of the following:

Trade debtors R

Loan to employee X R

Employee has left the employment and there is no trace of him.

Penalties and interest of R paid to SARS relating to late submissions of tax returns.

Ava was robbed at gunpoint on January The loss as a result of the robbery amounted to R

Ava paid R for accounting fees.

Rental of R was paid for a security system that will be used for the period March September

Ava paid R towards her pension fund.

Required:

Calculate Ava Mdluli's taxable income for the year of assessment. Hint: start your calculation with

Mart

the profit before tax figure that is given.

Ava is considering purchasing a piece of land adjoining her business premises to use as parking for her clients for an amount of R Advise Ava on whether the cost of the land would qualify as an allowable

Marh

deduction.

Discuss which pensions are exempt from tax.

Mark

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock