Question: QUESTION 3 ( 2 0 MARKS ) REQUIRED Study the information provided below and calculate the following: 3 . 1 The unit manufacturing cost per

QUESTION

MARKS

REQUIRED

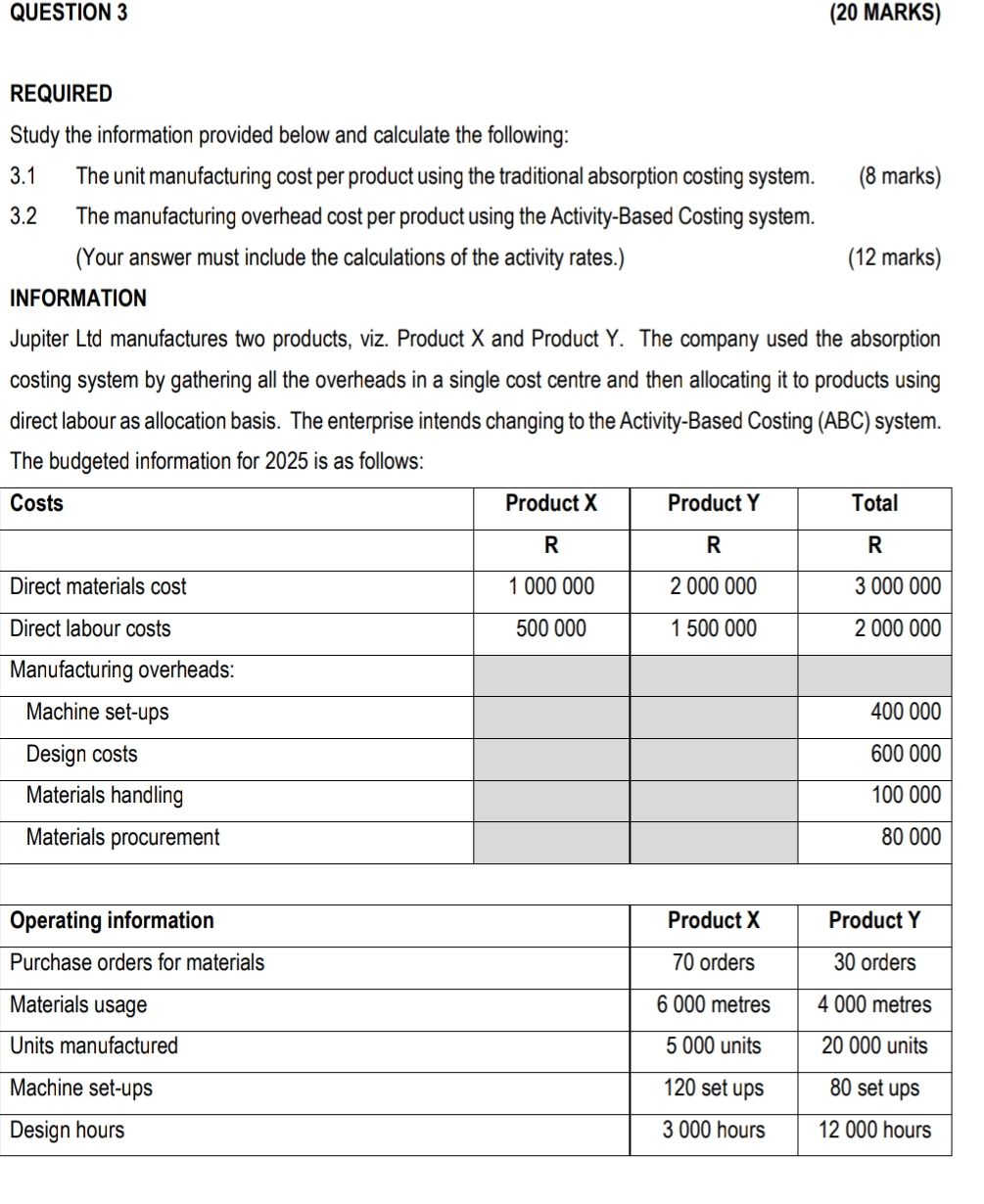

Study the information provided below and calculate the following:

The unit manufacturing cost per product using the traditional absorption costing system.

marks

The manufacturing overhead cost per product using the ActivityBased Costing system.

Your answer must include the calculations of the activity rates.

marks

INFORMATION

Jupiter Ltd manufactures two products, viz. Product and Product The company used the absorption costing system by gathering all the overheads in a single cost centre and then allocating it to products using direct labour as allocation basis. The enterprise intends changing to the ActivityBased Costing ABC system. The budgeted information for is as follows:

tableCostsProduct XProduct YTotalRRRDirect materials cost,Direct labour costs,Manufacturing overheads:,,,Machine setups,,,Design costs,,,Materials handling,,,Materials procurement,,,

tableOperating information,Product Product

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock