Question: Question 3 ( 2 0 marks ) You have been engaged by Alpha Corp. as a financial analyst to assist in determining their Weighted Average

Question marks

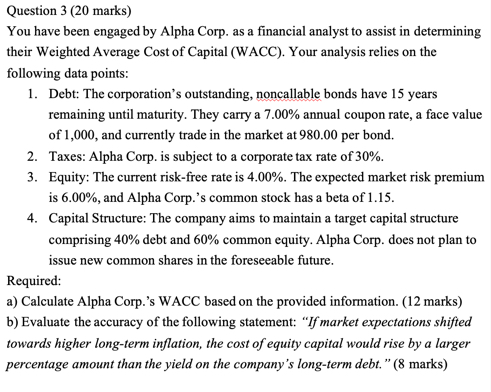

You have been engaged by Alpha Corp. as a financial analyst to assist in determining their Weighted Average Cost of Capital WACC Your analysis relies on the following data points:

Debt: The corporation's outstanding, noncallable bonds have years remaining until maturity. They carry a annual coupon rate, a face value of and currently trade in the market at per bond.

Taxes: Alpha Corp. is subject to a corporate tax rate of

Equity: The current riskfree rate is The expected market risk premium is and Alpha Corp.s common stock has a beta of

Capital Structure: The company aims to maintain a target capital structure comprising debt and common equity. Alpha Corp. does not plan to issue new common shares in the foreseeable future.

Required:

a Calculate Alpha Corp.s WACC based on the provided information. marks

b Evaluate the accuracy of the following statement: If market expectations shifted towards higher longterm inflation, the cost of equity capital would rise by a larger percentage amount than the yield on the company's longterm debt. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock