Question: Question 3 ( 2 0 points ) A company is considering whether to start a large project. It will cost the company $ 2 0

Question points

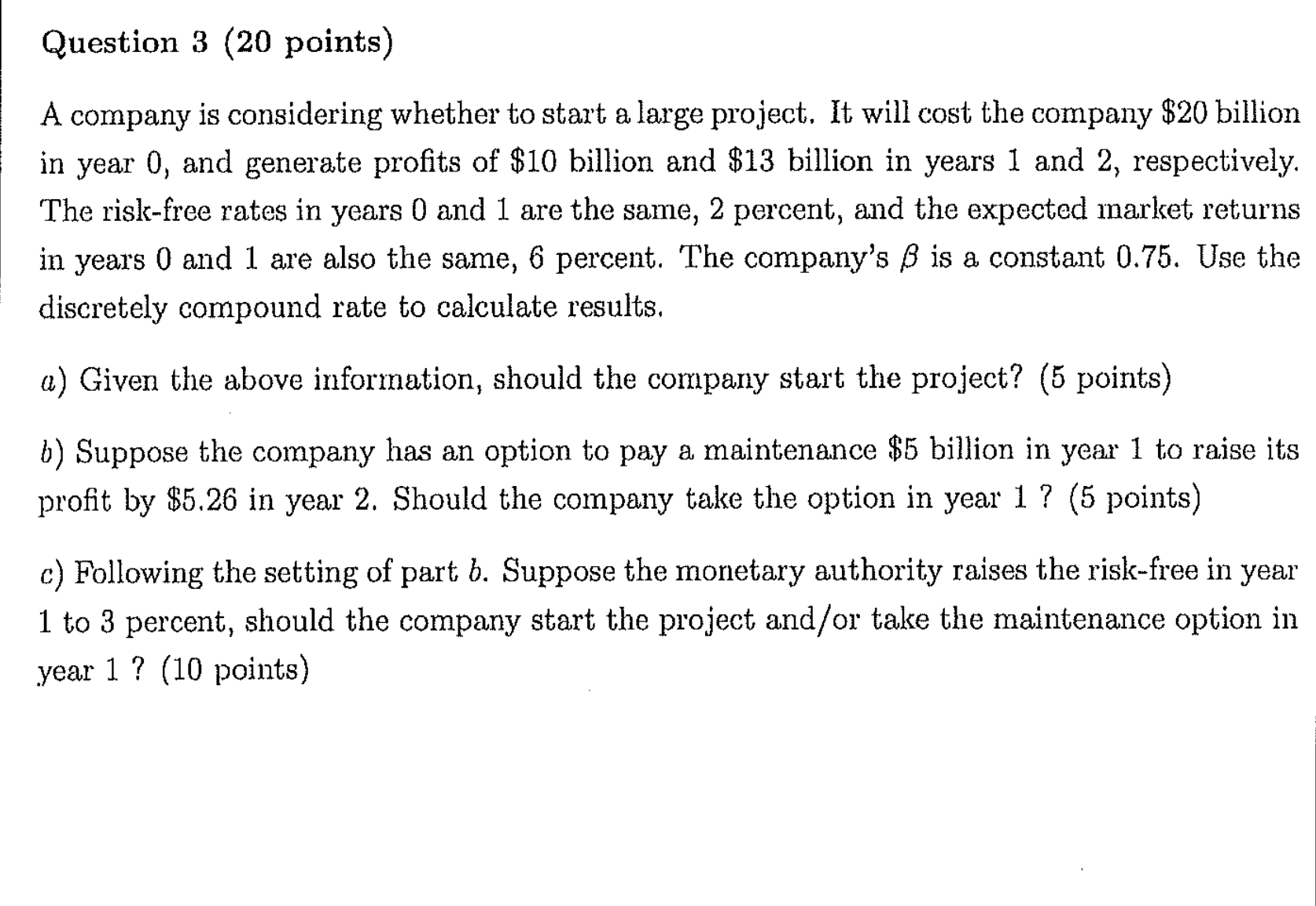

A company is considering whether to start a large project. It will cost the company $ billion

in year and generate profits of $ billion and $ billion in years and respectively.

The riskfree rates in years and are the same, percent, and the expected market returns

in years and are also the same, percent. The company's is a constant Use the

discretely compound rate to calculate results.

a Given the above information, should the company start the project? points

b Suppose the company has an option to pay a maintenance $ billion in year to raise its

profit by $ in year Should the company take the option in year points

c Following the setting of part Suppose the monetary authority raises the riskfree in year

to percent, should the company start the project andor take the maintenance option in

year points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock