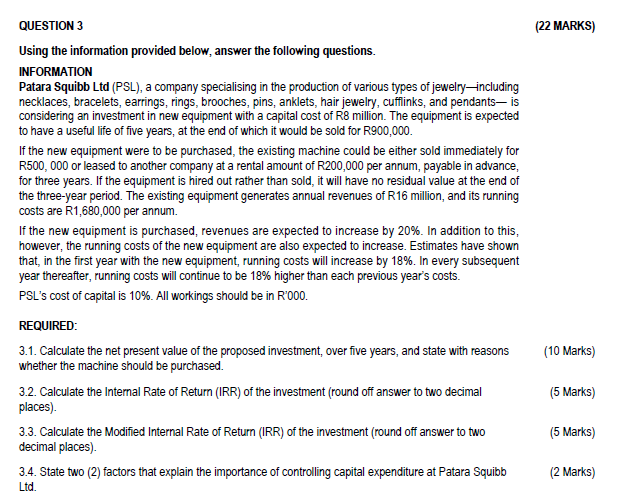

Question: QUESTION 3 ( 2 2 MARKS ) Using the information provided below, answer the following questions. INFORMATION Patara Squibb Ltd ( PSL ) , a

QUESTION MARKS Using the information provided below, answer the following questions. INFORMATION Patara Squibb Ltd PSL a company specialising in the production of various types of jewelryincluding necklaces, bracelets, earrings, rings, brooches, pins, anklets, hair jewelry, cufflinks, and pendants is considering an investment in new equipment with a capital cost of R million. The equipment is expected to have a useful life of five years, at the end of which it would be sold for mathrmR If the new equipment were to be purchased, the existing machine could be either sold immediately for mathrmR or leased to another company at a rental amount of R per annum, payable in advance, for three years. If the equipment is hired out rather than sold, it will have no residual value at the end of the threeyear period. The existing equipment generates annual revenues of R million, and its running costs are R per annum. If the new equipment is purchased, revenues are expected to increase by In addition to this, however, the running costs of the new equipment are also expected to increase. Estimates have shown that, in the first year with the new equipment, running costs will increase by In every subsequent year thereafter, running costs will continue to be higher than each previous year's costs. PSLs cost of capital is All workings should be in R REQUIRED: Calculate the net present value of the proposed investment, over five years, and state with reasons whether the machine should be purchased. Calculate the Internal Rate of Return IRR of the investment round off answer to two decimal places Calculate the Modified Internal Rate of Return IRR of the investment round off answer to two decimal places State two factors that explain the importance of controlling capital expenditure at Patara Squibb Ltd

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock