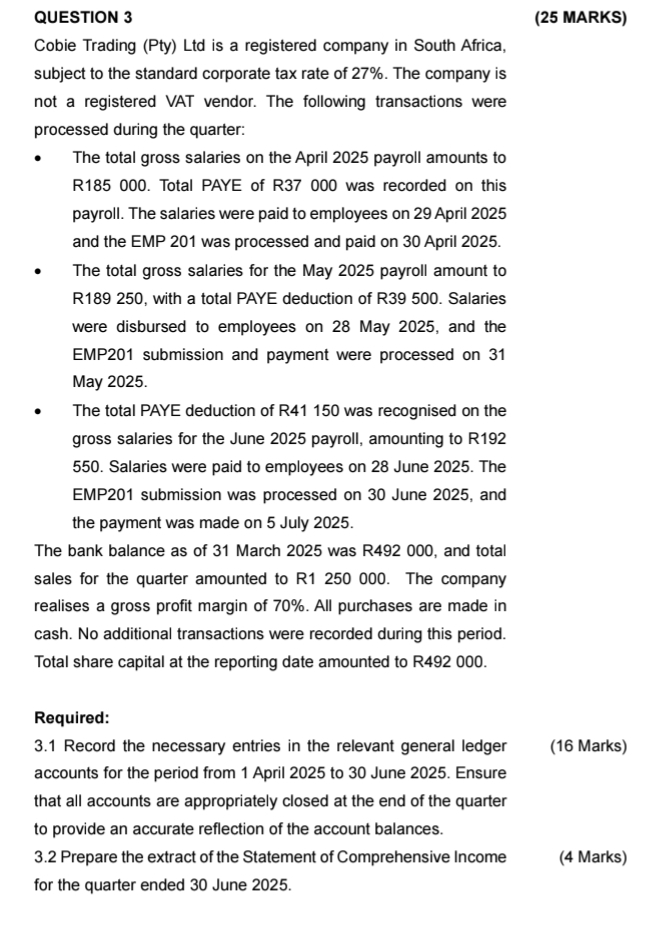

Question: QUESTION 3 ( 2 5 MARKS ) Cobie Trading ( Pty ) Ltd is a registered company in South Africa, subject to the standard corporate

QUESTION

MARKS

Cobie Trading Pty Ltd is a registered company in South Africa, subject to the standard corporate tax rate of The company is not a registered VAT vendor. The following transactions were processed during the quarter:

The total gross salaries on the April payroll amounts to R Total PAYE of R was recorded on this payroll. The salaries were paid to employees on April and the EMP was processed and paid on April

The total gross salaries for the May payroll amount to R with a total PAYE deduction of R Salaries were disbursed to employees on May and the EMP submission and payment were processed on May

The total PAYE deduction of R was recognised on the gross salaries for the June payroll, amounting to R Salaries were paid to employees on June The EMP submission was processed on June and the payment was made on July

The bank balance as of March was R and total sales for the quarter amounted to R The company realises a gross profit margin of All purchases are made in cash. No additional transactions were recorded during this period. Total share capital at the reporting date amounted to R

Required:

Record the necessary entries in the relevant general ledger

Marks accounts for the period from April to June Ensure that all accounts are appropriately closed at the end of the quarter to provide an accurate reflection of the account balances.

Prepare the extract of the Statement of Comprehensive Income

Marks for the quarter ended June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock