Question: Question 3 ( 2 5 Marks ) LS Printing Limited is a retailer listed on the NSX . The company distributes fast moving consumer goods

Question Marks

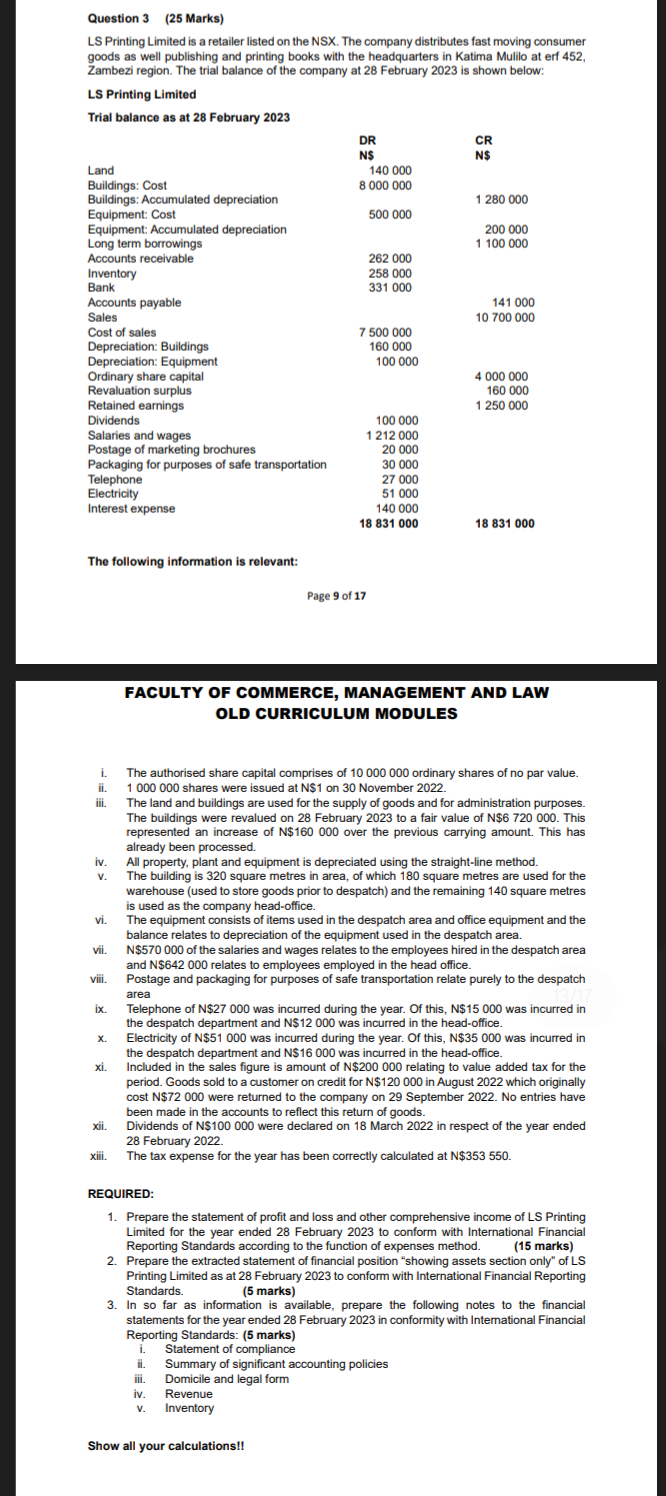

LS Printing Limited is a retailer listed on the NSX The company distributes fast moving consumer

goods as well publishing and printing books with the headquarters in Katima Mulilo at erf

Zambezi region. The trial balance of the company at February is shown below:

LS Printing Limited

Trial balance as at February

Land

Buildings: Cost

Buildings: Accumulated depreciation

Equipment: Cost

Equipment: Accumulated depreciation

Long term borrowings

Accounts receivable

Inventory

Bank

Accounts payable

Sales

Cost of sales

Depreciation: Buildings

Ordinary share capital

Revaluation surplus

Retained earnings

Dividends

Salaries and wages

Postage of marketing brochures

Packaging for purposes of safe transportation

Telephone

Electricity

Interest expense

DR

N$

CR

N$

The following information is relevant:

FACULTY OF COMMERCE, MANAGEMENT AND LAW

OLD CURRICULUM MODULES

i The authorised share capital comprises of ordinary shares of no par value.

ii shares were issued at N$ on November

iii. The land and buildings are used for the supply of goods and for administration purposes.

The buildings were revalued on February to a fair value of $ This

represented an increase of $ over the previous carrying amount. This has

already been processed.

iv All property, plant and equipment is depreciated using the straightline method.

v The building is square metres in area, of which square metres are used for the

warehouse used to store goods prior to despatch and the remaining square metres

is used as the company headoffice.

vi The equipment consists of items used in the despatch area and office equipment and the

balance relates to depreciation of the equipment used in the despatch area.

vii. N $ of the salaries and wages relates to the employees hired in the despatch area

and $ relates to employees employed in the head office.

viii. Postage and packaging for purposes of safe transportation relate purely to the despatch

area

ix Telephone of $ was incurred during the year. Of this, $ was incurred in

the despatch department and N$ was incurred in the headoffice.

x Electricity of $ was incurred during the year. Of this, $ was incurred in

the despatch department and N$ was incurred in the headoffice.

xi Included in the sales figure is amount of $ relating to value added tax for the

period. Goods sold to a customer on credit for N $ in August which originally

cost $ were returned to the company on September No entries have

been made in the accounts to reflect this return of goods.

xii. Dividends of N$ were declared on March in respect of the year ended

February

xiii. The tax expense for the year has been correctly calculated at $

REQUIRED:

Prepare the statement of profit and loss and other comprehensive income of LS Printing

Limited for the year ended February to conform with International Financial

Reporting Standards according to the function of expenses method. marks

Prepare the extracted statement of financial position "showing assets section only" of LS

Printing Limited as at February to conform with International Financial Reporting

Standards.

marks

In so far as information is available, prepare the following notes to the financial

statements for the year ended February in conformity with International Financial

Reporting Standards: marks

i Statement of compliance

ii Summary of significant accounting policies

iii. Domicile and legal form

iv Revenue

v Inventory

Show all your calculations!!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock