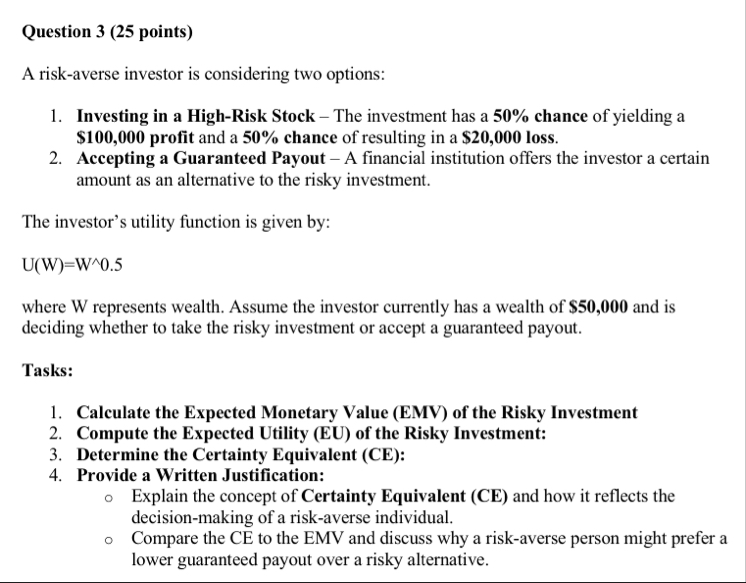

Question: Question 3 ( 2 5 points ) A risk - averse investor is considering two options: Investing in a High - Risk Stock - The

Question points

A riskaverse investor is considering two options:

Investing in a HighRisk Stock The investment has a chance of yielding a $ profit and a chance of resulting in a $ loss.

Accepting a Guaranteed Payout A financial institution offers the investor a certain amount as an alternative to the risky investment.

The investor's utility function is given by:

where W represents wealth. Assume the investor currently has a wealth of $ and is deciding whether to take the risky investment or accept a guaranteed payout.

Tasks:

Calculate the Expected Monetary Value EMV of the Risky Investment

Compute the Expected Utility EU of the Risky Investment:

Determine the Certainty Equivalent CE:

Provide a Written Justification:

Explain the concept of Certainty Equivalent CE and how it reflects the decisionmaking of a riskaverse individual.

Compare the CE to the EMV and discuss why a riskaverse person might prefer a lower guaranteed payout over a risky alternative.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock