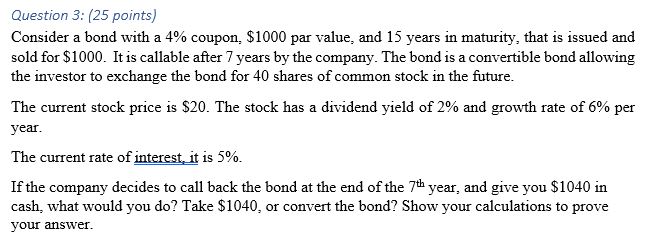

Question: Question 3 : ( 2 5 points ) Consider a bond with a ( 4 % ) coupon, ( $ 1 0 0 0 )

Question : points

Consider a bond with a coupon, $ par value, and years in maturity, that is issued and sold for $ It is callable after years by the company. The bond is a convertible bond allowing the investor to exchange the bond for shares of common stock in the future.

The current stock price is $ The stock has a dividend yield of and growth rate of per year.

The current rate of interest, it is

If the company decides to call back the bond at the end of the th year, and give you $ in cash, what would you do Take $ or convert the bond? Show your calculations to prove your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock