Question: Question 3 ( 2 9 marks ) Mavis is very interested in investing in the shares of companies in the cosmetics industry. She identified two

Question

marks

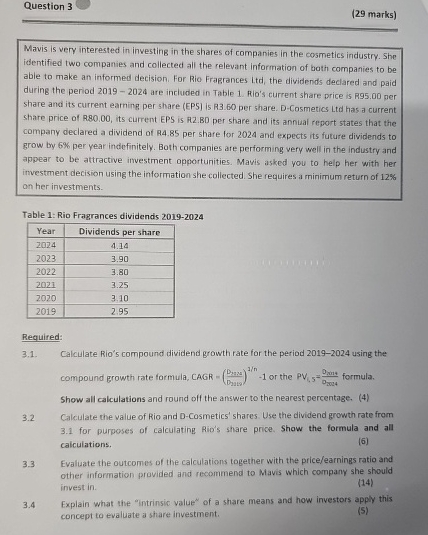

Mavis is very interested in investing in the shares of companies in the cosmetics industry. She identified two companies and collected all the relevant information of both companies to be able to make an informed decision. For Rio Fragrances Ltd the dividends declared and paid during the period are included in Table Ria's current share price is per share and its current earning per share EPS is R per share. DCosmetics Ltd has a current share price of R its current EPS is

RBD per share and its annual report states that the company declared a dividend of R per share for and expects its future dividends to grow by per year indefinitely. Both companies are performing very well in the industry and appear to be attractive investment opportunities. Mavis asked you to help her with her investment decision using the information she collected. She requires a minimum return of on her investments.

Table : Rio Fragrances dividends

tableYearDividends per share

Required:

Calculate Rio's compound dividend growth rate for the period using the compound growth rate formula, CAGR or the formula. Show all calculations and round off the answer to the nearest percentage.

Calculate the value of Rio and DCosmetics' shares. Use the dividend growth rate from for purposes of calculating Rio's share price. Show the formula and all calculations.

Evaluate the outcomes of the calculations together with the priceearnings ratio and other information provided and recommend to Mavis which company she should invest in

Explain what the "intrinsic value" of a share means and how investors apply this concept to evaluate a share investment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock