Question: Question 3 2 Jump to Qs 0 1 : 2 8 : 4 A taxpayer filing as Single has $ 2 5 , 6 0

Question

Jump to Qs

::

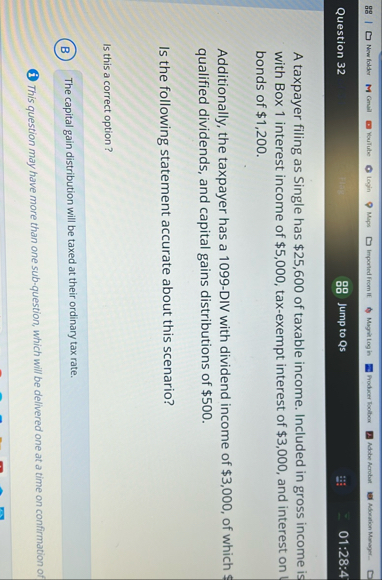

A taxpayer filing as Single has $ of taxable income. Included in gross income is with Box interest income of $ taxexempt interest of $ and interest on bonds of $

Additionally, the taxpayer has a DIV with dividend income of $ of which qualified dividends, and capital gains distributions of $

Is the following statement accurate about this scenario?

Is this a correct option?

The capital gain distribution will be taxed at their ordinary tax rate.

i This question may have more than one subquestion, which will be delivered one at a time on confirmation of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock