Question: Question 3 ( 2 points ) Martin Locks, a Canadian resident, owns 1 0 0 percent of the shares of Locks Inc., a Canadian corporation

Question points

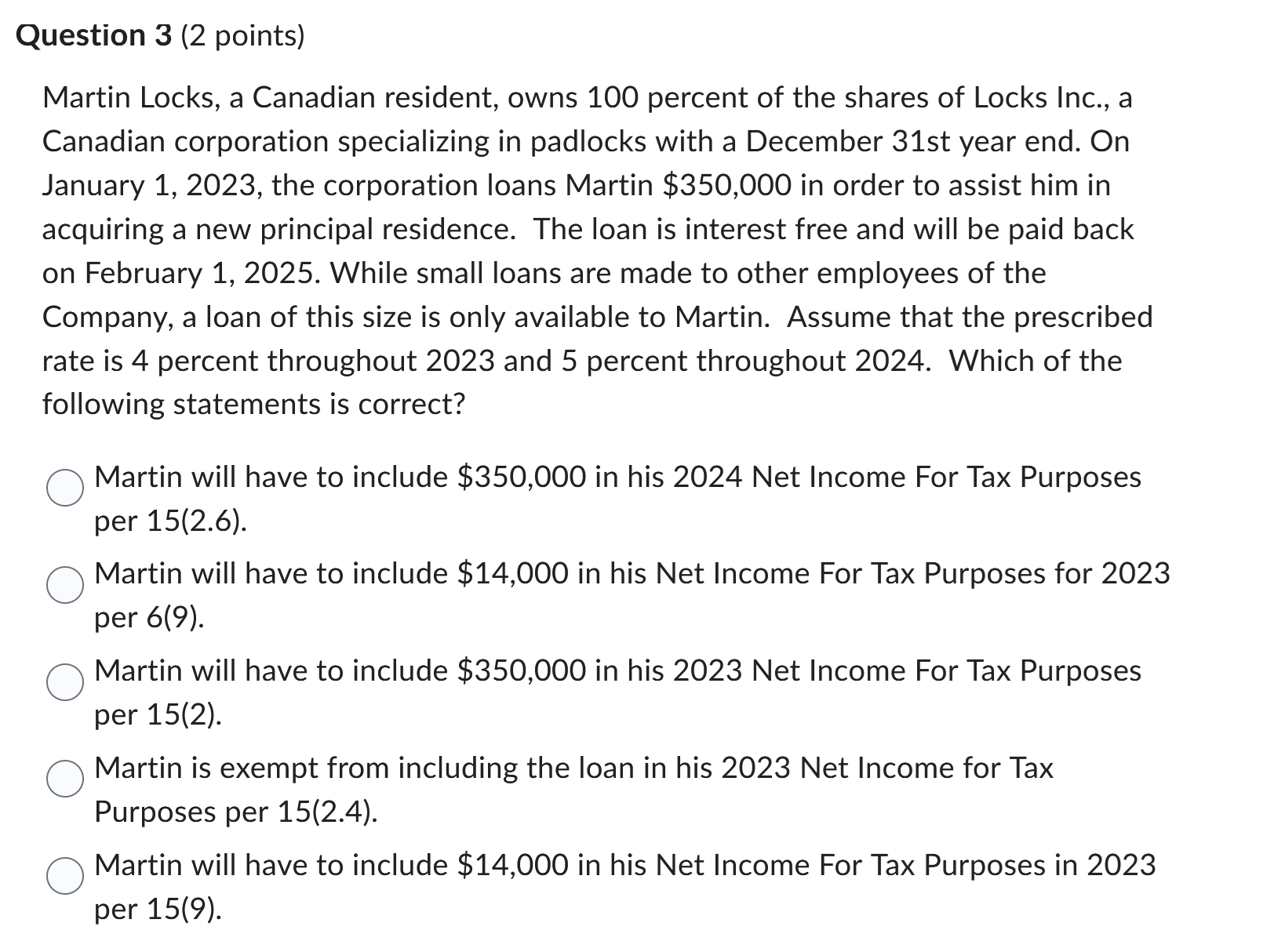

Martin Locks, a Canadian resident, owns percent of the shares of Locks Inc., a Canadian corporation specializing in padlocks with a December st year end. On January the corporation loans Martin $ in order to assist him in acquiring a new principal residence. The loan is interest free and will be paid back on February While small loans are made to other employees of the Company, a loan of this size is only available to Martin. Assume that the prescribed rate is percent throughout and percent throughout Which of the following statements is correct?

Martin will have to include $ in his Net Income For Tax Purposes per

Martin will have to include $ in his Net Income For Tax Purposes for per

Martin will have to include $ in his Net Income For Tax Purposes per

Martin is exempt from including the loan in his Net Income for Tax Purposes per

Martin will have to include $ in his Net Income For Tax Purposes in per

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock