Question: Question 3 2 points Save Answer Generic numerical entry instructions: Enter only your final numerical answer, rounded and expressed as requested and the only non-number

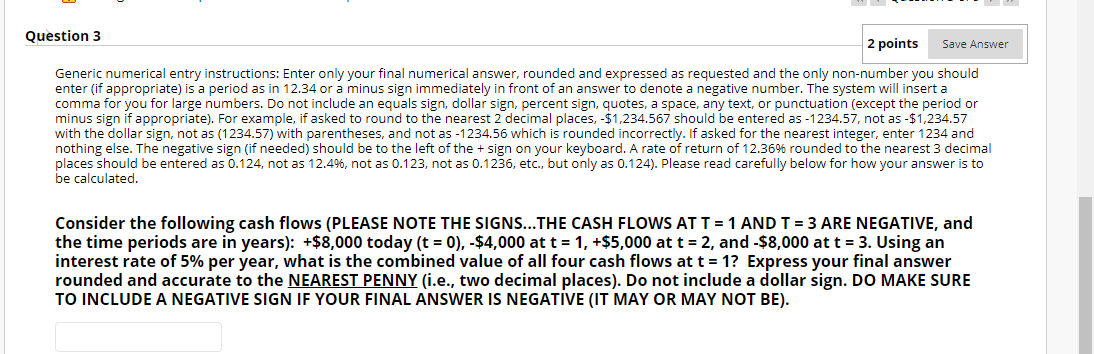

Question 3 2 points Save Answer Generic numerical entry instructions: Enter only your final numerical answer, rounded and expressed as requested and the only non-number you should enter (if appropriate) is a period as in 12.34 or a minus sign immediately in front of an answer to denote a negative number. The system will insert a comma for you for large numbers. Do not include an equals sign, dollar sign, percent sign, quotes, a space, any text, or punctuation (except the period or minus sign if appropriate). For example, if asked to round to the nearest 2 decimal places, -$1,234.567 should be entered as - 1234.57, not as -$1,234.57 with the dollar sign, not as (1234.57) with parentheses, and not as -1234.56 which is rounded incorrectly. If asked for the nearest integer, enter 1234 and nothing else. The negative sign (if needed) should be to the left of the + sign on your keyboard. A rate of return of 12.36% rounded to the nearest 3 decimal places should be entered as 0.124, not as 12.4%, not as 0.123, not as 0.1236, etc., but only as 0.124). Please read carefully below for how your answer is to be calculated. Consider the following cash flows (PLEASE NOTE THE SIGNS...THE CASH FLOWS AT T = 1 AND T = 3 ARE NEGATIVE, and the time periods are in years): +$8,000 today (t = 0), -$4,000 at t = 1, +$5,000 at t = 2, and $8,000 at t = 3. Using an interest rate of 5% per year, what is the combined value of all four cash flows at t = 1? Express your final answer rounded and accurate to the NEAREST PENNY (i.e., two decimal places). Do not include a dollar sign. DO MAKE SURE TO INCLUDE A NEGATIVE SIGN IF YOUR FINAL ANSWER IS NEGATIVE (IT MAY OR MAY NOT BE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts