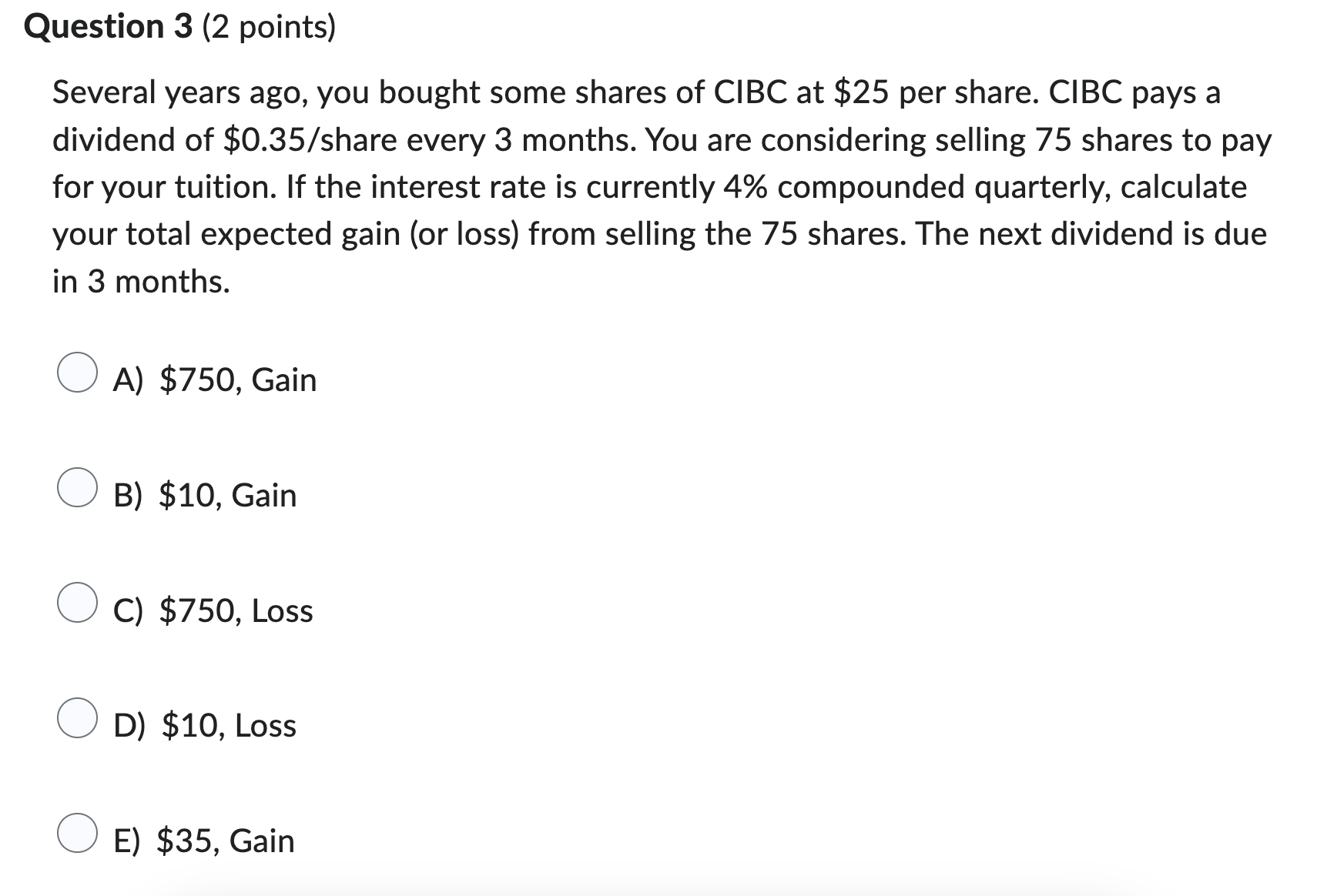

Question: Question 3 ( 2 points ) Several years ago, you bought some shares of CIBC at ( $ 2 5 ) per

Question points Several years ago, you bought some shares of CIBC at $ per share. CIBC pays a dividend of $ share every months. You are considering selling shares to pay for your tuition. If the interest rate is currently compounded quarterly, calculate your total expected gain or loss from selling the shares. The next dividend is due in months. A$ Gain B$ Gain C$ Loss D$ Loss E$ Gain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock