Question: Question 3 (2 points) You are evaluating a potential investment in equipment. The equipment's basic price is $126,000, and shipping costs will be $3,800. It

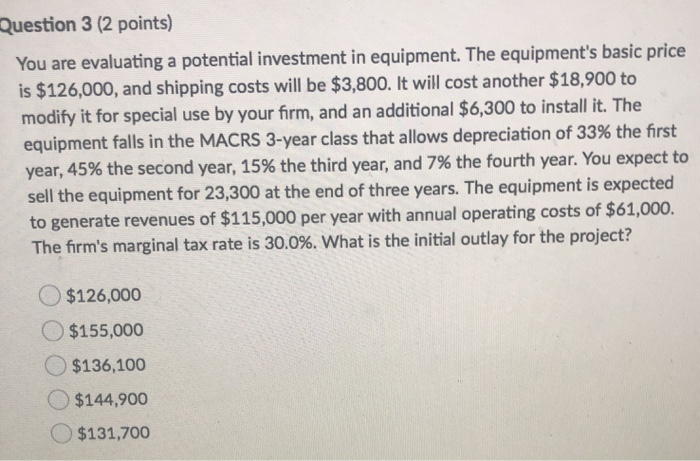

Question 3 (2 points) You are evaluating a potential investment in equipment. The equipment's basic price is $126,000, and shipping costs will be $3,800. It will cost another $18,900 to modify it for special use by your firm, and an additional $6,300 to install it. The equipment falls in the MACRS 3-year class that allows depreciation of 33% the first year, 45% the second year, 15% the third year, and 7% the fourth year. You expect to sell the equipment for 23,300 at the end of three years. The equipment is expected to generate revenues of $115,000 per year with annual operating costs of $61,000. The firm's marginal tax rate is 30.0%. What is the initial outlay for the project? $126,000 $155,000 $136,100 $144,900 $131,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts