Question: Question 3 (20 marks) (a) B & B Ltd. has a weighted average cost of capital of 10.5%. The company's cost of equity is 15.5%,

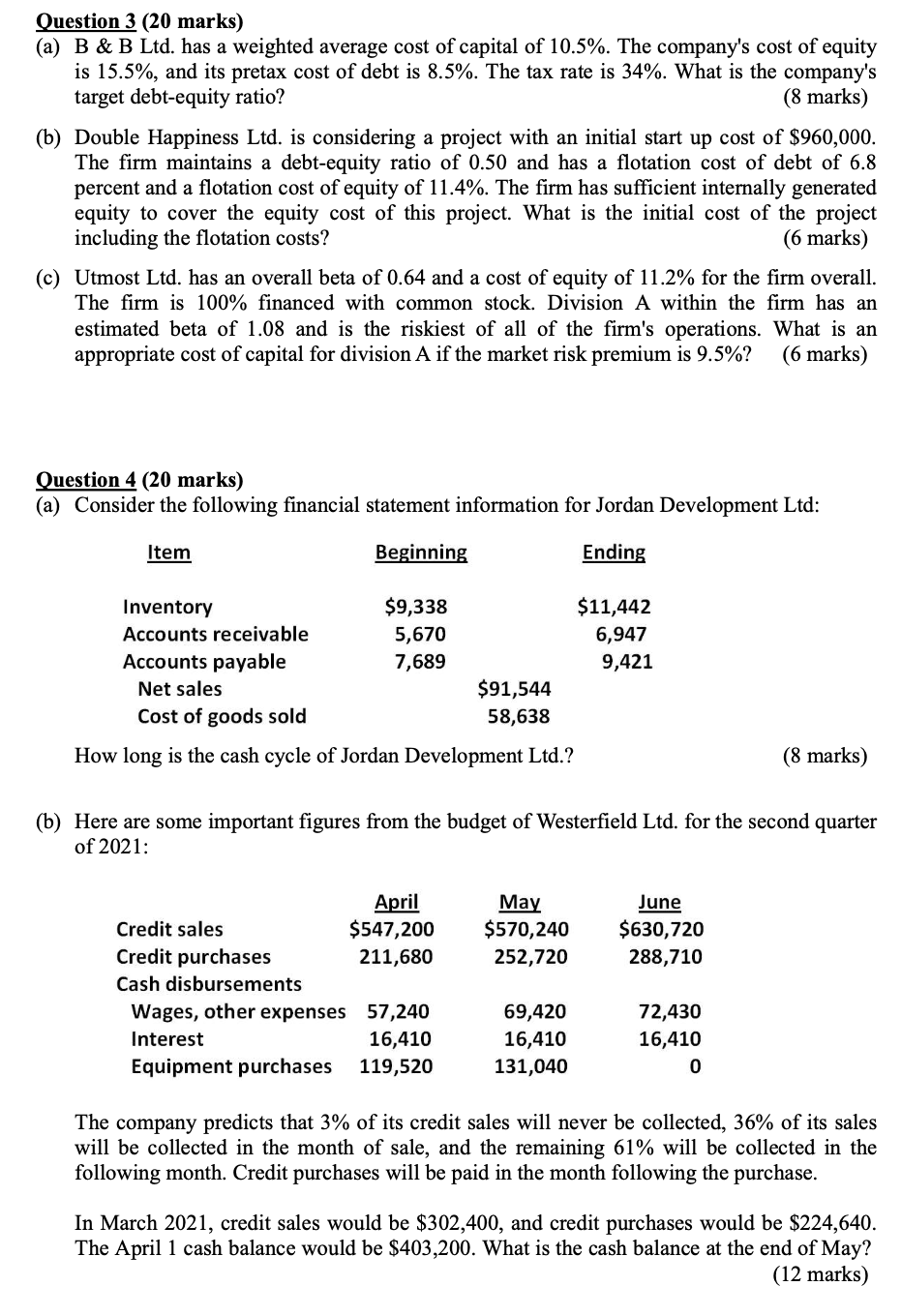

Question 3 (20 marks) (a) B & B Ltd. has a weighted average cost of capital of 10.5%. The company's cost of equity is 15.5%, and its pretax cost of debt is 8.5%. The tax rate is 34%. What is the company's target debt-equity ratio? (8 marks) (b) Double Happiness Ltd. is considering a project with an initial start up cost of $960,000. The firm maintains a debt-equity ratio of 0.50 and has a flotation cost of debt of 6.8 percent and a flotation cost of equity of 11.4%. The firm has sufficient internally generated equity to cover the equity cost of this project. What is the initial cost of the project including the flotation costs? (6 marks) (c) Utmost Ltd. has an overall beta of 0.64 and a cost of equity of 11.2% for the firm overall. The firm is 100% financed with common stock. Division A within the firm has an estimated beta of 1.08 and is the riskiest of all of the firm's operations. What is an appropriate cost of capital for division A if the market risk premium is 9.5%? (6 marks) Question 4 (20 marks) (a) Consider the following financial statement information for Jordan Development Ltd: Item Beginning Ending Inventory Accounts receivable Accounts payable Net sales Cost of goods sold $9,338 5,670 7,689 $11,442 6,947 9,421 $91,544 58,638 How long is the cash cycle of Jordan Development Ltd.? (8 marks) (b) Here are some important figures from the budget of Westerfield Ltd. for the second quarter of 2021: May $570,240 252,720 June $630,720 288,710 April Credit sales $547,200 Credit purchases 211,680 Cash disbursements Wages, other expenses 57,240 Interest 16,410 Equipment purchases 119,520 69,420 16,410 131,040 72,430 16,410 0 The company predicts that 3% of its credit sales will never be collected, 36% of its sales will be collected in the month of sale, and the remaining 61% will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2021, credit sales would be $302,400, and credit purchases would be $224,640. The April 1 cash balance would be $403,200. What is the cash balance at the end of May? (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts