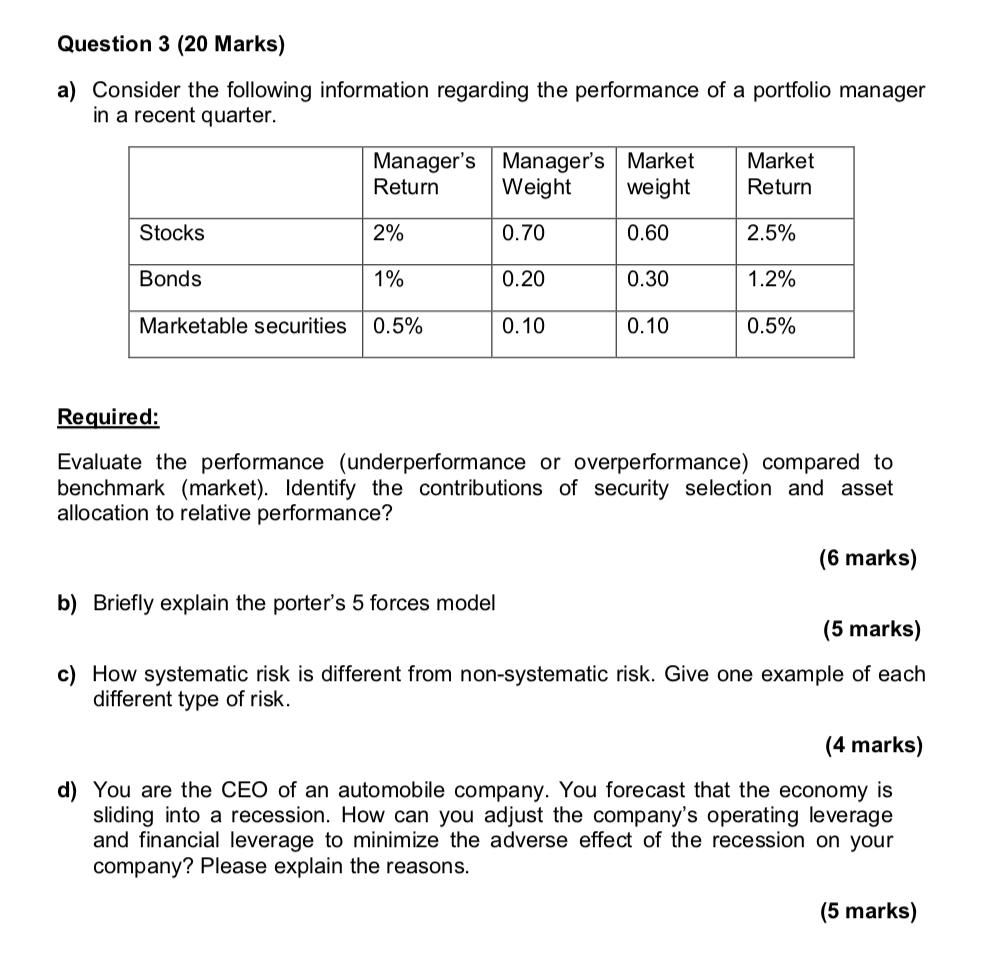

Question: Question 3 (20 Marks) a) Consider the following information regarding the performance of a portfolio manager in a recent quarter. Manager's Market weight Weight Manager's

Question 3 (20 Marks) a) Consider the following information regarding the performance of a portfolio manager in a recent quarter. Manager's Market weight Weight Manager's Return Market Return 2% Stocks 0.70 0.60 2.5% 1% Bonds 0.20 0.30 1.2% 0.5% Marketable securities 0.5% O.10 0.10 Required: erperformance) erperformance benchmark (market). Identify the contributions of security selection and asset Evaluate the compare rmance (u to allocation to relative performance? (6 marks) b) Briefly explain the porter's 5 forces model (5 marks) c) How systematic risk is different from non-systematic risk. Give one example of each different type of risk. (4 marks) d) You are the CEO of an automobile company. You forecast that the economy is sliding into a recession. How can you adjust the company's operating leverage and financial leverage to minimize the adverse effect of the recession on your company? Please explain the reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts